Workforce and skills

To support the net zero transition, building a skilled workforce for advanced manufacturing is crucial for Australia’s economic growth and prosperity. Key areas of focus include attracting young people to manufacturing careers, diversifying the workforce, reskilling existing workers, and modernising training so it is relevant and up to date. In line with findings from Jobs and Skills Australia, considerations in skills, location, timing and preferences will need to be made to deliver targeted, localised and individualised supports to drive successful outcomes for workers and their communities (Jobs and Skills Australia, 2025).

As new technologies are developed and adopted, new skills and specialised training will be required to design, install, operate and maintain future systems. Vocational education and training (VET) system reforms will help deliver an adaptable, skilled workforce resilient to the structural changes of the net zero transition and support micro‑credentials in the training system to deliver in‑time training to meet emerging and urgent skills needs. Peak bodies, such as A2EP and the Energy Efficiency Council, will be helpful in delivering trusted advice to build industry awareness on the skills necessary to support a specialised implementation workforce. In addition, through the Australian Government’s Green Metals Innovation Network, the CSIRO in collaboration with HILT CRC will identify pathways to support a strong Australian metals workforce.

The Clean Energy Capacity Study found that Australia ‘can’t grow the workforce at the pace and scale required if large groups of the population are excluded, including women, First Nations people, people with disability, and recent migrants whose skills’ potential are underutilised.’ (Jobs and Skills Australia, 2023). Creating conditions in the industrial sector that support increased participation from women and other underrepresented groups would help address workforce shortages, in alignment with the Australian Government’s ambitions in Working for Women: a Strategy for Gender Equality. State‑led programs such as, Victoria’s ‘Making it Equal’ and Queensland’s Women in Manufacturing, alongside federal reforms for fair hiring practices, pay transparency, and more inclusive workplaces will be an important aspect of this effort.

First Nations communities to share in the benefits of industrial net zero

Australia’s net zero transformation presents a unique opportunity to deepen our engagement with First Nations communities through partnerships that are built on respect, shared value and long‑term benefit. As industries transition to cleaner energy and technologies, many projects and their enabling infrastructure (e.g. renewable energy, hydrogen developments) will be located on land with Native Title, rights and interests.

Industrial decarbonisation can empower First Nations communities as key partners in Australia’s clean energy future. Working in partnership with First Nations communities, especially during the planning stage, and by creating pathways for employment, training and business participation, industrial decarbonisation can support cultural heritage and economic empowerment.

Meaningful collaboration with First Nations communities is necessary for industries, helping to develop trust with their local communities, avoid costly delays and build new opportunities. The First Nations Clean Energy Strategy can provide a helpful guide to support benefits for First Nations Australians. Engaging collaboratively to achieve positive outcomes for local communities, including First Nations communities is one of the Community Benefit Principles under Future Made in Australia.

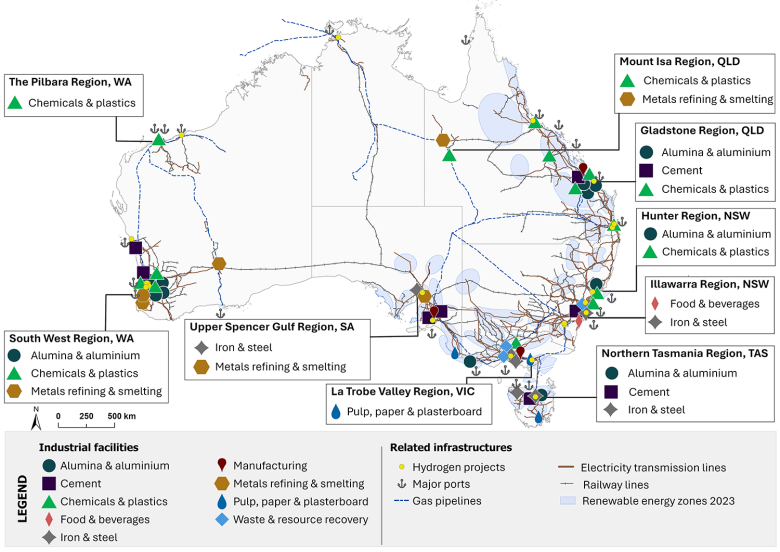

Industrial transition will rely on grid infrastructure and access to renewable energy

As industrial facilities such as aluminium smelters, alumina refineries and food and beverage manufacturers increasingly prepare to shift to renewable energy, they require tailored grid infrastructure and renewable investments to support their net zero operations. This includes transmission and distribution grid upgrades, as well as access to the necessary renewable generation and firming. Depending on the location of facilities and the nearby existing grid infrastructure, industries may consider partial or completely off‑grid solutions to be a cost‑effective method for accessing renewable energy. However, off‑grid solutions present their own complications and costs, including the need for sufficient access to land for renewable developments. Most existing industrial facilities will still likely require tailored on‑grid connections to support their decarbonisation pathways.

Investment in industrial decarbonisation will require coordinated regional infrastructure planning to deliver renewable energy and firming to industry users. Recent developments such as Rio Tinto’s multiple power purchase agreements, comprising 2.7 GW of wind and solar for their assets in Gladstone, show a potential way forward (Rio Tinto, 2025). These agreements will help repower Rio Tinto’s industrial facilities with renewables, including the Boyne aluminium smelter, Yarwun alumina refinery and the QAL alumina refinery. Use of offtake agreements can help de‑risk investments for industrial decarbonisation, drive large renewable investment, and help negotiate affordable electricity prices. Proactive grid planning from grid bodies such as AEMO, state and federal governments, and network providers to consider industry specific needs will help to reduce the chance of costly delays. Reforming regulatory processes for approvals for renewables and transmission infrastructure will also be key enablers for the renewable rollout.

Industry is an active player in the grid

Continued grid transition and increased share of variable renewables will need to be balanced with demand flexibility from all areas of the economy, including industry. Industry will need to consider options for reducing energy demand when demand and supply balance is tight (e.g. load‑shedding), increasing industrial demand when there is excess renewable supply (e.g. load‑taking) and providing other grid stability services to help deliver a cost effective system. This industrial demand flexibility is also discussed in the Electricity and Energy Sector Plan and can help optimise grid infrastructure, minimising the delivered cost of renewable electricity and supporting industries to remain competitive.

The Reliability and Emergency Reserve Trader (RERT) process presents an example of demand flexibility arrangements. The RERT is a mechanism for AEMO to maintain reliability by calling on large industrial users such as aluminium smelters (with the necessary assets) to voluntarily reduce their electricity demand during times of tight demand and supply balance to support grid stability. In turn these participating facilities are compensated for these services (AEMO, 2024). While providing these grid services is not a core business for industrial facilities, the RERT represents an example of how industry can play a more active role in the grid while receiving an additional source of revenue. Additional opportunities for demand flexibility are being assessed as part of the National Electricity Market Wholesale Market Settings Review.

Other tools to support demand flexibility include energy performance upgrades and onsite (behind‑the‑meter) generation and storage. Demand flexibility via onsite energy storage assets (batteries, hot water storage, thermal energy storage etc.) can be particularly useful by providing business with ways to store and use energy independently from the grid for short periods of time. These tools provide opportunities for a more active participation in the grid, such as load shifting and energy arbitrage, providing benefits to both industry and the wider grid.

To encourage the widespread uptake of industrial demand flexibility, the cost and benefits of industrial participation will need to be carefully balanced. Trials such as AGL’s Dynamic Pricing Load Flex Trial are currently underway to better understand this balance and is complemented by new market mechanisms and intermediaries such as storage brokers.

Market demand will help de-risk investments

Market demand for lower‑emission products will bring confidence for business and enable them to invest in industrial decarbonisation efforts. This is particularly important for industries with low margins such as cement, steel, aluminium and chemicals where significant capital is required for decarbonisation. Strong demand drivers, either through government procurement, regulatory requirements, consumer demand or business commitments to net zero, will help de‑risk critical investments such as new boilers, kilns, furnaces etc. needed for net zero.

Work is already underway on this, including through Materials and Embodied Carbon Leaders’ Alliance (MECLA), helping to reduce the embodied carbon in the building and construction industry. This helps support the adoption of lower emission products from the steel, cement, aluminium and other construction material subsectors. Additional opportunities are highlighted in other sector plans, many of which rely on inputs from the industrial sector. The Built Environment Sector Plan and Transport Sector Plan have strong linkages to the steel and cement subsectors for the buildout of new buildings and infrastructure. Other opportunities include lower emission explosives and fertilisers from chemical manufacturers for the Resources and Agricultural and Land Use Sector Plans. Local content policies that encourage use of low emission products also help build momentum in markets, supporting the scale up of manufacturing capability and unlocking advantages from economies of scale.

International market demand for lower emission and green products is also growing and is one of the key drivers for investment and opportunities under the Future Made in Australia agenda. Global demand for green commodities is expanding, driven by government policies such as Europe’s Carbon Border Adjustment Mechanism, as well as net zero commitments from businesses around the world. Successfully attracting this international market demand to Australian producers and investments will be key to unlocking a Future Made in Australia and its economic opportunities around green metals and other clean exports. Measures including the Investor Front Door, the Guarantee of Origin scheme, the Sustainable Finance Roadmap and Sustainable Finance Taxonomy are already underway to help streamline global and domestic investments (see also Chapter 10 of the NZP ‘Attracting investment to achieve net zero’).