Economic modelling and analysis by the Treasury explores plausible scenarios of Australia’s transition to net zero by 2050. This work informs the development of the Australian Government’s Net Zero Plan and sector plans and includes potential economy‑wide and sector‑specific emissions reductions pathways. The RSP considers the Baseline Scenario, in which Australia efficiently builds on existing climate policies and trends.

Under the Baseline Scenario:

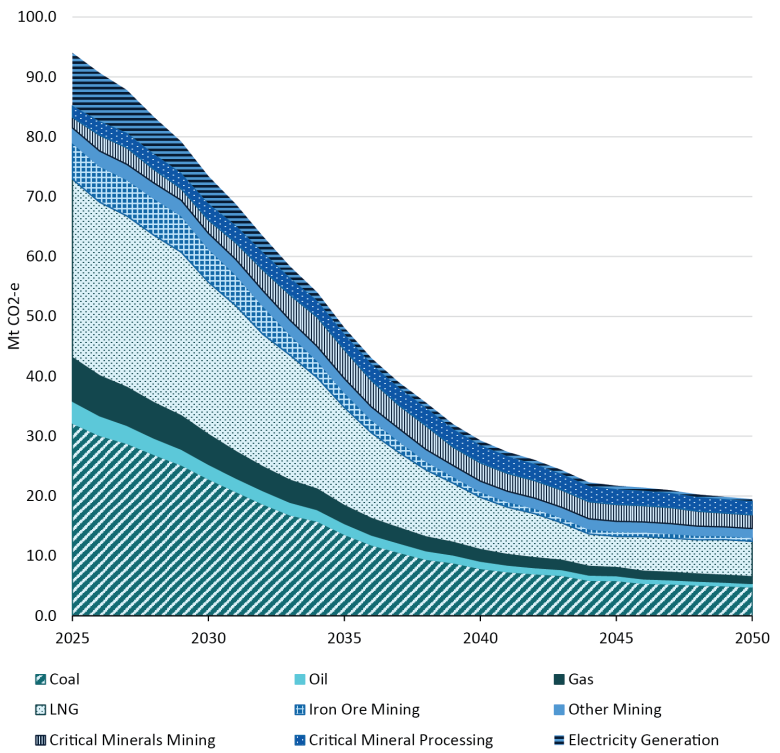

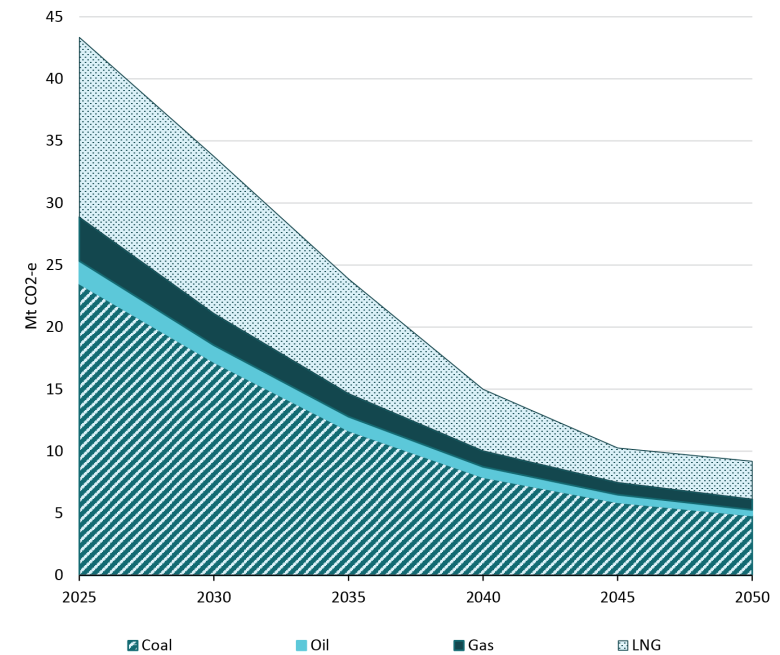

- Through to 2050, Australia’s commodity exports are expected to shift from hydrocarbon energy commodities towards minerals and resources essential for global decarbonisation.

- Emissions from Australia’s resources sector are projected to reduce from 94 Mt CO2‑e in 2025 to 19 Mt CO2‑e in 2050. In 2050, emissions from the resources sector are projected to make up 12% of economy‑wide gross emissions.

To achieve the necessary reduction in emissions while supporting energy security and increasing output through to 2050, operations in the sector will focus on lowering emissions intensity (Treasury 2025). This is especially the case for energy commodities and emissions‑intensive mining activities that will continue to play a role in the transition.