The Australian resources sector has and will continue to capitalise on new technologies, systems and approaches to managing its own emissions. The pathway to net zero will be enabled by 3 trends:

- reducing fuel combustion emissions

- reducing fugitive emissions

- scaling up carbon management technologies.

Reducing fuel combustion emissions

Energy efficiency | Demand flexibility | Electrification or fuel switching

Reducing fuel combustion emissions is a key priority for the resources sector, given the scale of diesel and gas use across extraction and processing activities. Electrification and fuel switching are credible pathways for many companies, including through the adoption of low‑carbon fuels such as renewable diesel and other low‑carbon liquid fuels where renewable infrastructure is not available. Energy performance will underpin emissions reductions at the lowest cost within the sector (DCCEEW 2024d). (Note: Energy performance is the broad management of energy demand, including energy efficiency, electrification or fuel switching and demand flexibility.)

The sector will pursue innovative technologies to improve energy performance, focusing on efficiency in extraction and processing, precision in resource mapping, and operational optimisation (MCA 2017). These improvements will help reduce emissions, energy usage and operating costs.

Electrifying vehicles and equipment across resources facilities will significantly reduce diesel consumption, which currently accounts for most energy use on‑site (in 2020–2021, 95% for mine sites) (Advisian 2022). Electrification enables the sector to leverage firmed renewable energy capacity, including within major grids across Australia. The sheer scale and distance of some on‑site operations, such as train and large vehicle haulage across expansive mine sites, presents a substantial technical and logistical challenge. Analysis from research and stakeholder engagement suggests that electrified haulage options are rapidly improving, with broader uptake expected over the next decade. This trajectory reflects the sequencing challenges posed by existing asset lifecycles and the infrastructure requirements necessary to support electrification.

Given many resources facilities are located in remote locations with limited grid access, off‑grid solutions may offer a practical and effective decarbonisation pathway in many cases. The sector is currently collaborating with technology and service providers to accelerate innovation and deployment of electrified solutions.

Operators are increasingly partnering with energy providers and independent power producers to deploy off‑grid systems powered by renewables. As renewable energy capacity at remote sites becomes more resilient and efficient, mining operations will be able to deploy electrified vehicles and equipment at scale.

Other operations (in particular, but not exclusively, offshore facilities) are unable to develop on‑site renewable generation or connect to larger electricity grids due to location, cost associated with transmission or environmental constraints. In these cases, facilities will need to meet any applicable decarbonisation requirements by pursuing the most economically viable options available to them.

While long‑distance freight emissions and electricity transmission infrastructure fall outside the scope of this plan, they are critical enablers of the transition and are addressed in the Transport and Electricity and Energy Sector Plans respectively.

Low‑carbon fuels will offer an alternative to diesel and natural gas, particularly where electrification is not feasible, such as in remote areas where transmission infrastructure is too expensive to deploy. These fuels are a valuable decarbonisation option, with examples including biodiesel, renewable diesel, ammonia‑based fuels and hydrogen.

The Australian Government is taking steps to accelerate the growth of domestically produced, cost‑competitive low‑carbon fuels under the Future Made in Australia agenda. To build a supply chain for Australian low carbon liquid fuels, the Australian Government will invest $1.1 billion in a new Cleaner Fuels Program. This will help stimulate private investment in Australia’s first onshore low carbon liquid fuel refineries, backing local innovators, making fuel supply more resilient and bridging the price gap for early adopters. The government will engage with industry on how to make sure Australian liquid fuel users have a fair chance to capture the emissions reduction potential unlocked by low-emission Australian fuels. More detail can be found in the Net Zero Plan and Electricity and Energy Sector Plan.

Gas as a chemical feedstock to manufacturing processes cannot be electrified and will require direct substitution. Altering the feedstock used in a process is not straightforward, as chemical processes are typically fully integrated into the facility. This means investment in new infrastructure and supply chains will be required. Transition is likely to require a change to the whole operation rather than a gradual change to the facility. Such changes involve significant capital outlays and require extensive testing and planning.

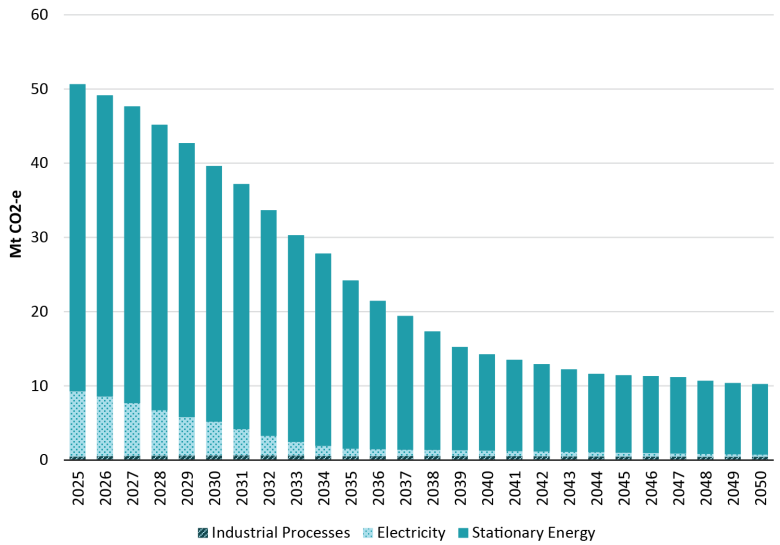

Treasury’s Baseline Scenario indicates that in 2050, fuel combustion emissions in the sector will reduce to around 20% of what they are in 2025, as seen below.