Principle 6: Australia is, and will remain, a reliable trading partner for energy, including Liquefied Natural Gas (LNG) and low emission gases. Australia’s ambition to become a renewable energy superpower will involve developing new, low emissions energy exports to support the energy security and decarbonisation efforts of our trade partners.

Summary

Australian gas, exported as LNG, plays a central role in energy security and supports living standards in our region. It supports a reliable electricity supply and provides gas for cooking and cooling or heating homes in cities like Tokyo, Beijing, Seoul, Singapore, and Taipei. It will also support regional electricity grids as they transition from coal-fired power generation towards renewables.

We have seem large scale investment from regional partners in Australia’s LNG industry over recent decades. This has benefits both to our trade partners, who rely on LNG for energy and as an input to many basic goods and services, and to Australia’s economy.

During the transition to net zero, our trade partners’ economies will change and the pathways they take to get there will differ. Ultimately, many of our trade partners will have a harder task compared to Australia because of their limited availability of cheap, reliable energy. Australian LNG will play a vital role in providing a reliable supply of electricity as renewable power sources become a larger part of the energy mix in our region, and as we work together to make low-emission gases like hydrogen more cost effective and readily available.

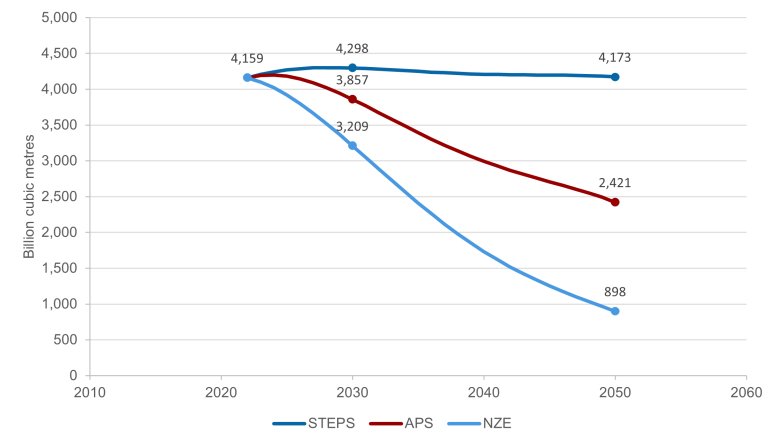

In all the scenarios considered in this strategy, Australia’s LNG exports decline by 2050 (note this is not a policy setting). However, LNG still has a clear role to play in 2050 and beyond. By remaining a reliable LNG supplier and responsible climate actor, Australia can build new partnerships in emerging energy industries like hydrogen and clean energy exports. These relationships are important to Australia’s national prosperity and to our domestic energy transformation.

While reductions in LNG demand are forecast over time, Australia is acting now to reduce LNG-related emissions. Reducing the emissions intensity of LNG and gas production in Australia advances our region’s climate and energy goals. It also presents opportunities to scale carbon management solutions such as carbon capture and storage.

Continued supply of LNG can reduce the carbon intensity of our region’s energy mix, including by replacing more emissions intensive fuels like coal. It will also support security and stability in energy markets as our trade partners to meet their climate commitments. Our LNG industry understands that this does not mean business as usual. Emissions from the extraction of gas and production of LNG are estimated to account for around 8% of Australia’s total greenhouse gas emissions. These emissions must reduce for Australia to achieve net zero.

Scenarios are used to help shape forecasts in this section. Learn more about these scenarios in Appendix A.

Read Section 2 of the analytical report for more information about Australia’s gas emissions, and Section 4 for more information about the international demand for natural gas.

How are Australia’s LNG exports consumed today?

Australia accounts for a fifth of the global LNG trade. In 2022–23, Australia exported 81Mt of LNG, which is similar to the volumes exported by the US and Qatar. Australia has been a trusted and reliable energy export partner for many years. This trust is founded on a framework of long-term investments and contracts with Northeast Asian consumers, which provides price and volume security over a long-term time horizon. Between 2010 and 2022, the cumulative investment in Australia’s oil and gas sector was more than $398 billion (DISR 2024).

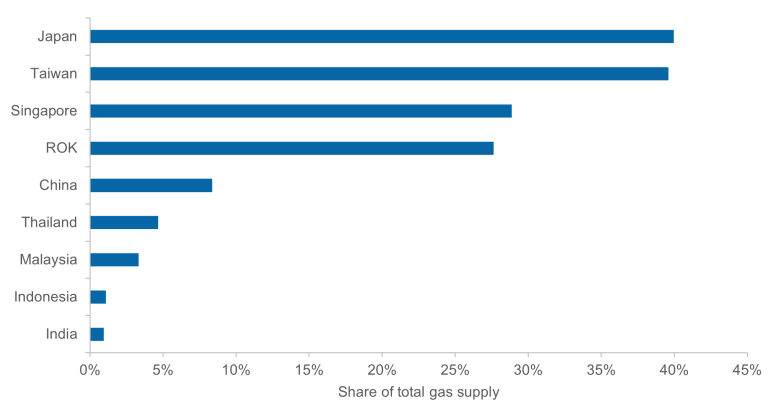

Nearly 90% of Australian LNG exports go to Japan (36%), China (28%), the Republic of Korea (ROK) (14%) and Taiwan (11%). Japan, the ROK and Taiwan rely on imports to meet most of their energy needs. The lack of energy self-sufficiency in these economies means they must depend on other economies for access to reliable and affordable energy supplies.

Australian LNG meets industrial energy needs and generates electricity for major cities across Asia

Australian LNG ensures a reliable electricity supply in cities like Tokyo, Osaka, Seoul, Singapore and large cities in China, complementing the broader energy mix in each economy. The graph below shows Australia’s share of total gas supply to key international trade partners. To put this into perspective, of the 12 million people live in Tokyo’s metropolitan area, more than half of them are supplied by LNG imported from Australia.