Principle 1: Australia is committed to supporting global emissions reductions to reduce the impacts of climate change and will reach net zero emissions by 2050. Gas production and use must be optimised through the transition and residual use must be abated or offset to achieve this economy-wide commitment.

Summary

In 2050, Australia’s natural gas use will look very different from today. Australia cannot reach our 2050 net zero targets without reducing and decarbonising our consumption of natural gas. Natural gas consumption will continue on the pathway to net zero. Decarbonising natural gas use in Australia will need:

- increased energy efficiency and electrification of processes that currently use natural gas

- replacing natural gas with low-emission gases

- any remaining emissions from natural gas use to be reduced as low as possible, and where not possible, fully offset.

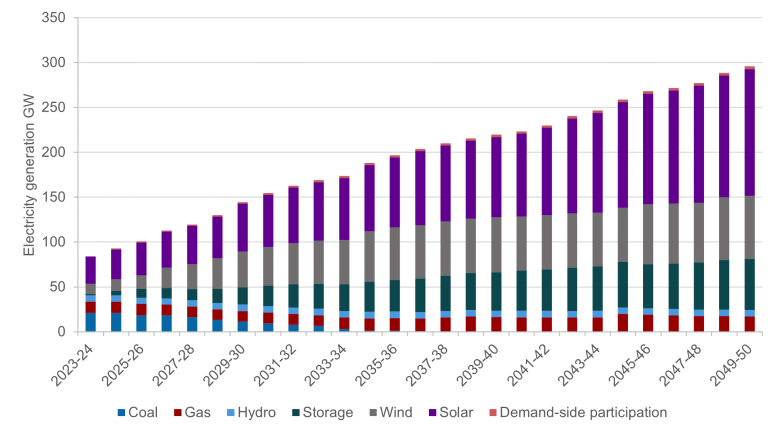

Gas consumption is not uniform across sectors or across Australia. Gas is used by households and small businesses, by industry and in power generation. Each of these broad sectors has a different pattern of gas consumption.

Gas is used in all states and territories. Each state and territory also has a different pattern of gas consumption.

Read Appendix A for information about the scenarios are used to help shape forecasts in this section.

Read Section 3 of the analytical report for analysis of domestic demand for natural gas.

Gas use in Australia’s transition to a net zero economy

Gas will support our economy during the transition to net zero and will remain a critical part of the energy landscape in 2050 and beyond. Transforming how we make products and power our economy will be challenging, but the energy transformation is already underway.

Technologies allowing households and businesses to decarbonise are becoming increasingly available. For industrial gas use, the transition pathway is more complex and will depend on the cost and availability of alternatives. In some cases, these alternatives will require new technologies. In other cases, solutions will combine existing technologies in new ways. A challenge for governments, society, investors, and market participants will be to maintain investment across the energy sector at the pace required to achieve net zero.

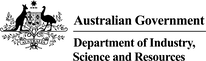

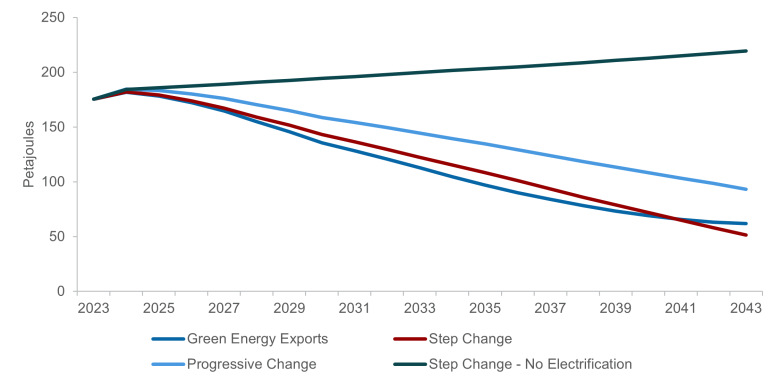

We explore these opportunities and challenges based on detailed projections of the east coast and west coast gas demand scenarios produced each year by the Australian Energy Market Operator (AEMO).

Australia’s forecast natural gas demand depends on many factors. Each AEMO projection is based on assumptions about how quickly we adopt alternatives to gas, as well as social and economic conditions. These projections reflect the best knowledge available.

The largest declines in gas consumption are anticipated in east coast buildings

The largest declines in gas demand on the east coast are forecast for commercial and residential buildings. Depending on the scenario, by 2043, domestic and small business consumption of gas will decline between 49% and 72% on 2023 levels. This is unless residential and commercial consumers are unable, or choose not to, electrify. These projections assume an increase in the rate of electrification (the replacement of existing gas appliances with electric alternatives), and a reduction in the rate of new natural gas connections.