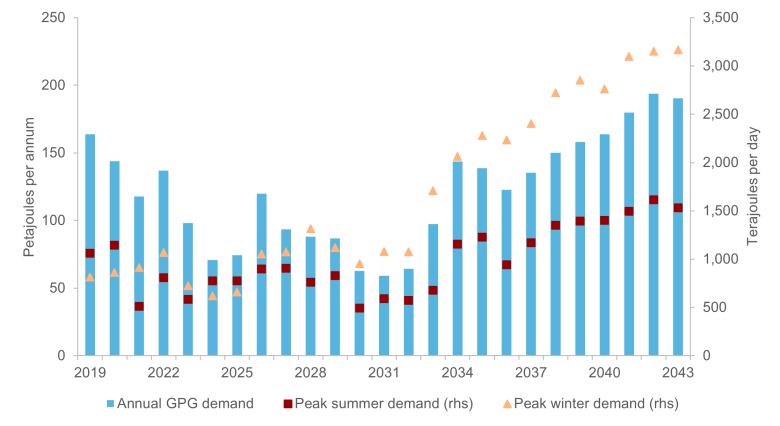

Peaking and firming GPG is an important component of the National Energy Market (NEM) to 2050 and beyond. Demand for natural gas by the GPG sector will depend on the availability of low-carbon alternatives such as hydrogen, energy storage and the ability to abate natural gas safely and effectively.

On the west coast, GPG will continue to be an important source of electricity generation. It will continue to provide firming and peaking support as more renewables enter the system and low-carbon alternatives become economically viable through to 2050 and beyond. Small-scale generation on mine sites could switch to GPG or to renewables firmed by GPG.

Across Australia, the future demand for natural gas for GPG to 2050 and beyond will be highly dependent on the speed and timing of technological development and commercialisation of low-carbon alternatives. These alternatives include hydrogen powered generators, pumped hydro, batteries, biomethane and other biofuels.

The Australian Government, in partnership with the states and territories, is active in supporting this transition. The $20 billion Rewiring the Nation program will modernise Australia’s electricity grids and deliver new and upgraded transmission infrastructure. The Capacity Investment Scheme will encourage new investment in new renewable capacity nationally. Building on the National Energy Transformation Partnership framework, these measures will deliver the Australian Government’s 82% renewable electricity by 2030 target.

Why will Australian industry and manufacturers still need gas in the future?

Gas demand from Australian industrial users is likely to remain stable to at least 2035. Demand reduction by east coast industrial and mining consumers is expected to be modest. The west coast and the Northern Territory have a high concentration of industries which use high heat, as well as large mining and minerals processing sectors. The modest overall projected declines in gas consumption reflect how industrial and mining uses offer the most challenging prospects for abatement.

Reducing demand may require:

- advancement in a range of different technologies

- changes in industry operations that switch from carbon-based feedstocks to alternative inputs

- electrification of high-heat processes or switching to low-emissions gases.

The need for gas in high-heat manufacture of products such as concrete, glass and steel, will likely persist. Low and some medium heat applications are expected to be electrified as commercial alternatives scale up, and become more cost competitive and operationally reliable. Higher heat applications require technologies that need further research, development, and operational testing. Some users may also need to turn to gas to replace more polluting fossil fuels on the pathway to net zero.

Gas as a chemical feedstock to manufacturing processes cannot be electrified and will require direct substitution. Altering the feedstock used in a process is not straightforward, as chemical processes are typically fully integrated into the facility. This means investment in new infrastructure and supply chains will be required. Transition is likely to require a change to the whole operation rather than a gradual change to the facility. Such changes involve significant capital outlays and require extensive testing and planning.

The pathway to decarbonisation is likely to involve increased demand for gas for some users. The steel industry provides a good demonstration of this. Today’s steel production involves passing inputs of iron ore, coking (metallurgical) coal and limestone through a blast furnace and basic oxygen furnace to produce steel. Emissions per tonne of steel are 2.2t CO2. Replacing coal with natural gas in direct reduced iron and electric arc furnaces significantly reduces emissions to 1.4t CO2. As a result, the natural gas demand from steelmaking will increase, but emissions will reduce.