Latest developments

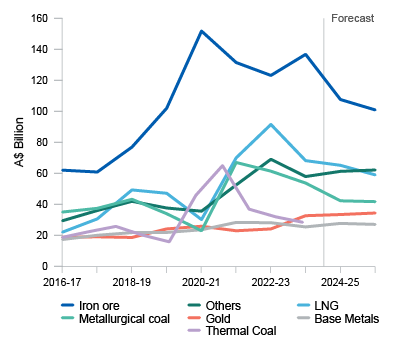

Australian resources and energy exports are forecast to continue to ease after the record peak seen in 2022–23.

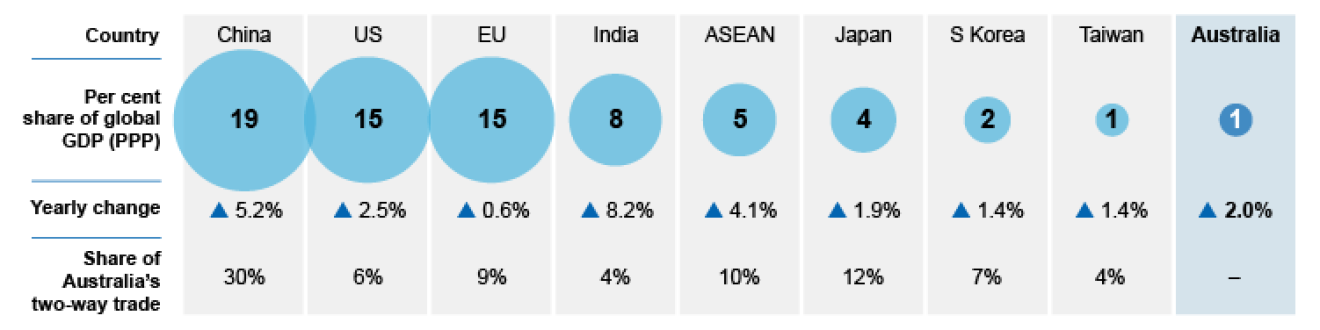

- The near-term outlook for Australian resource and energy commodity exports has worsened in net terms since the June 2024 REQ. Economic growth in the major Western economies remains constrained by tight monetary policy. China’s economy remains impacted by a weak property sector. But the outlook is for an improvement in world economic growth in 2025 and 2026.

- The rising AUD/USD and lower commodity prices are forecast to see Australia’s resource and energy exports decline to $372 billion in 2024–25, down from $415 billion in 2023–24. A further decline to $354 billion is forecast in 2025–26.

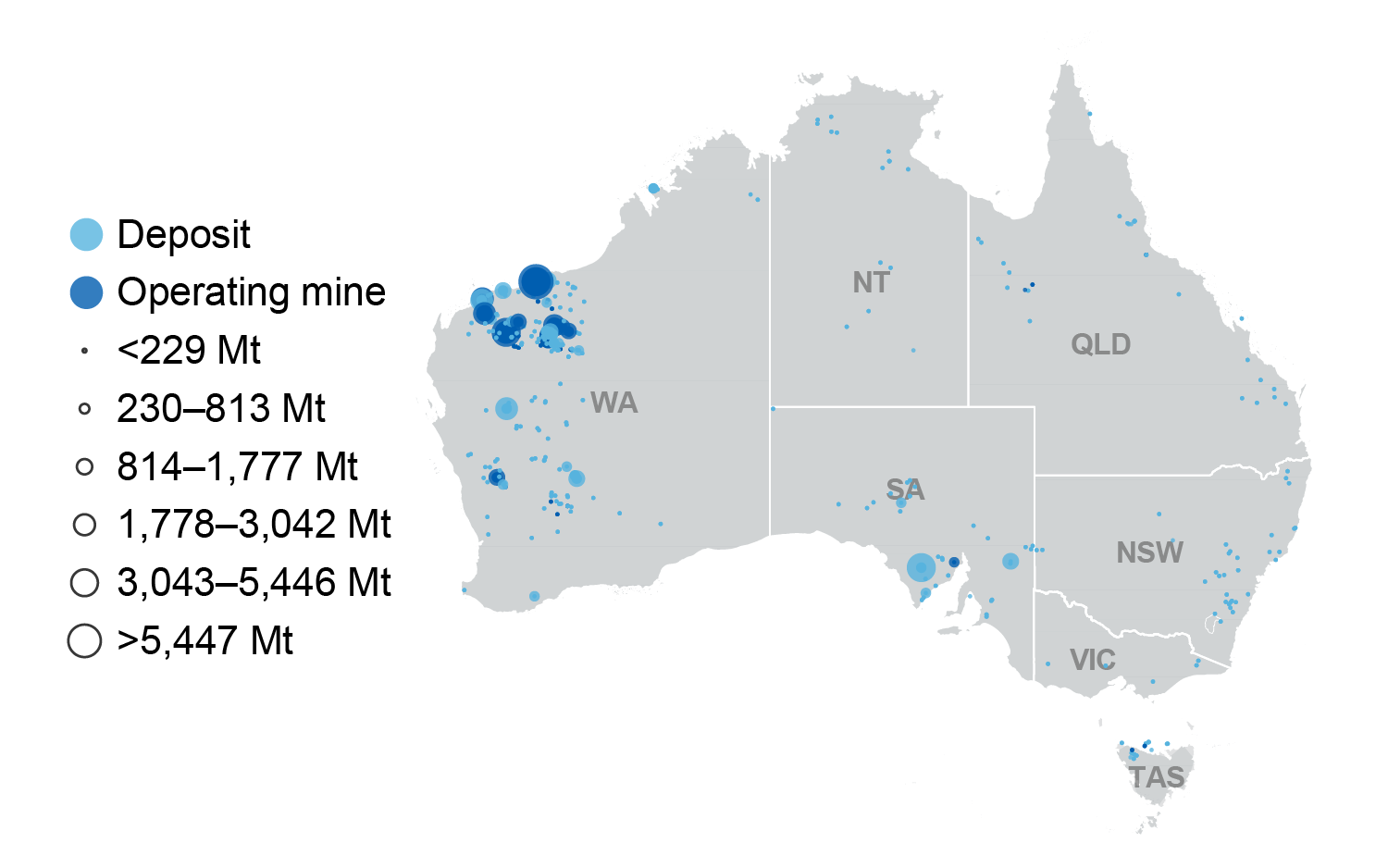

- The gold price has hit a new record high, but iron ore prices have declined as the Chinese property sector remains weak. Nickel and lithium prices remain weak.