Latest developments

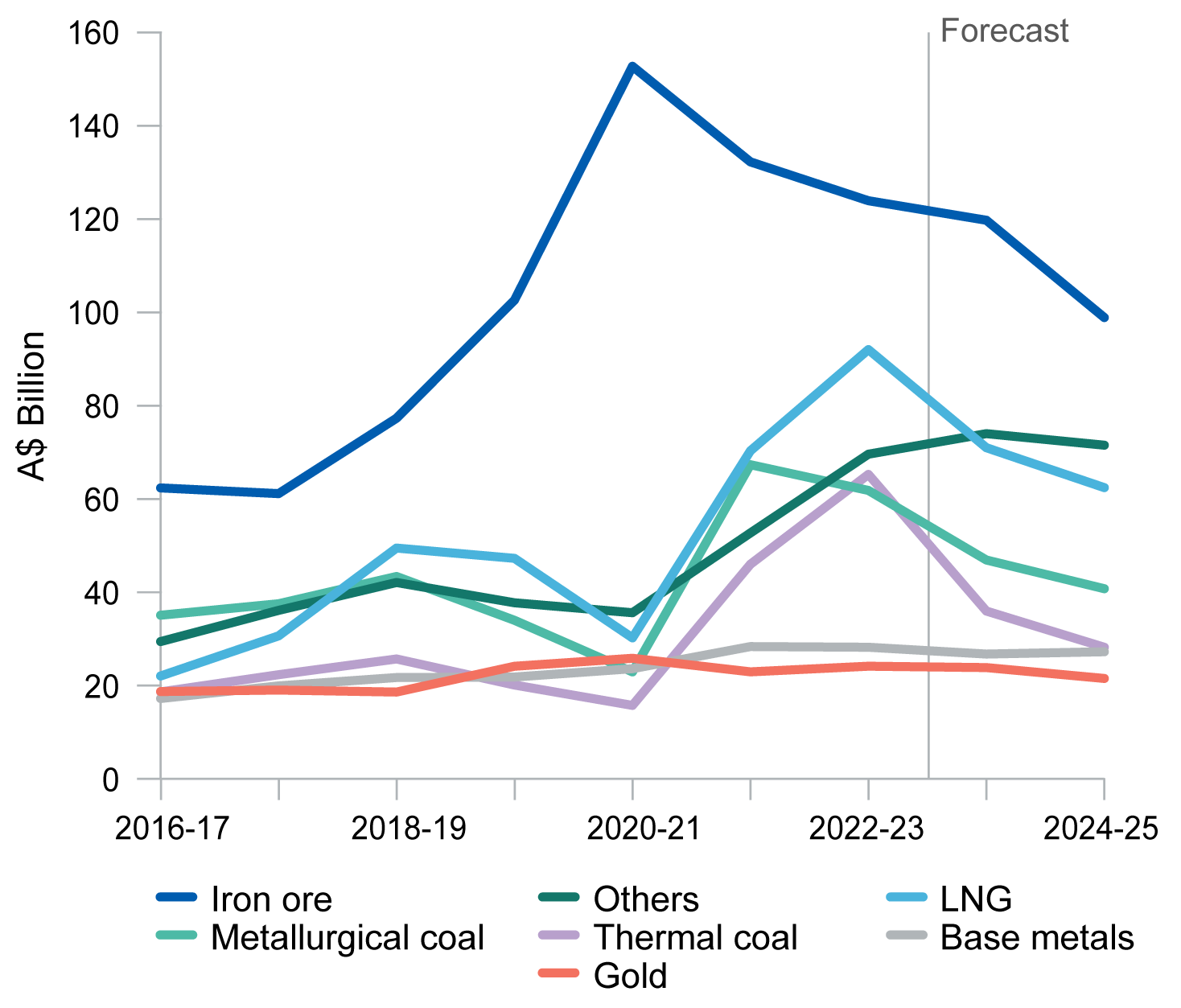

Australia’s resource and energy export earnings are forecast to decline from the record $467 billion in 2022–23.

- Resource and energy commodity prices fell further in the September quarter 2023, driven by supply and demand factors mostly pushing in the same direction. However, supply cuts by some major oil producers are helping stabilise oil prices. Consumers replenishing from already low inventories is also helping support the price of oil and other commodities.

- After a record $467 billion of export earnings in 2022–23, weaker world demand and improving world commodity supplies are expected to reduce Australia’s earnings to $400 billion in 2023–24, with another significant fall likely in 2024–25.

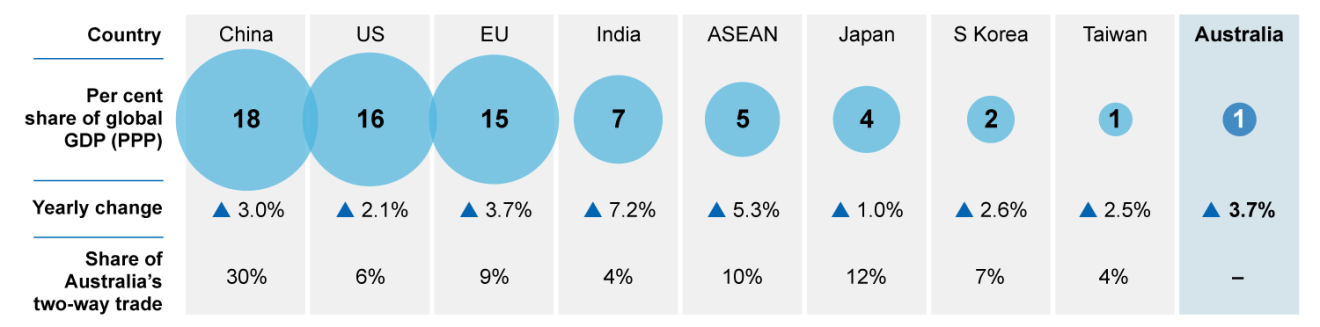

- There are rising concerns about economic growth in China. Despite the end of COVID lockdowns, structural and cyclical factors are causing China’s growth to remain relatively weak. This has implications for world commodity markets and Australia as a major supplier of commodities and services to China.