Latest developments

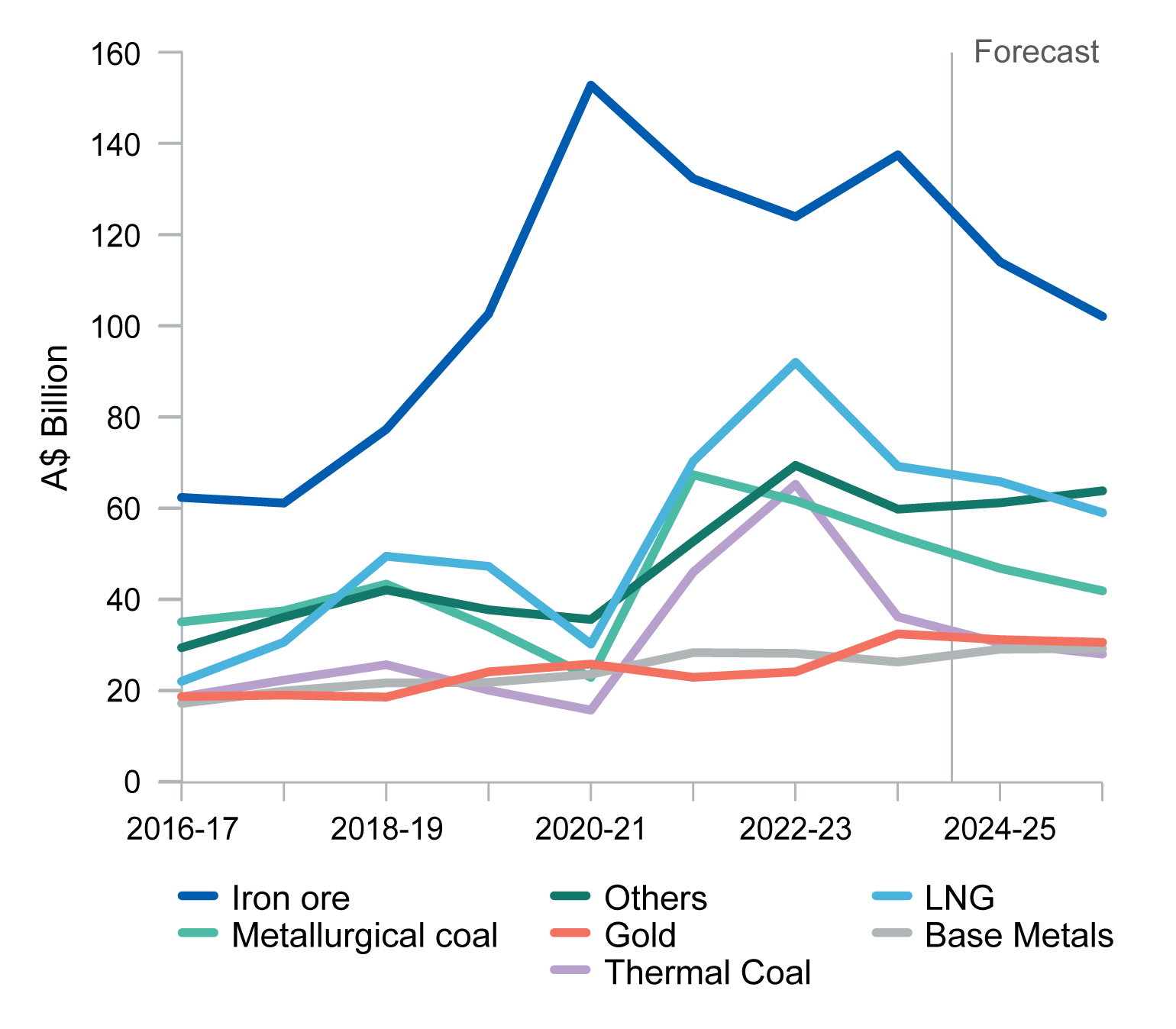

Australian resources and energy exports are forecast to continue to ease after the record peak seen in 2022–23.

- The near-term outlook for Australian resource and energy commodity exports has improved slightly in net terms since the March 2024 REQ. Major economies have seen a modest uptick in economic activity, and the outlook is for an improvement in world economic growth in 2025 once monetary policy becomes less restrictive in major Western economies.

- Relatively weak growth in world demand and rising world commodity supply has seen Australia’s resource and energy exports decline to an estimated $417 billion in 2023–24 from $466 billion in 2022–23. A decline to $380 billion is forecast in 2024–25, as commodity prices drift down further and the AUD/USD lifts. A further modest decline to $356 billion is forecast in 2025–26, as prices start to bottom out.

- Nickel and lithium prices have managed to make modest recoveries as global supply is wound back closer to demand. Gold has hit a new record high since the March quarter 2024, and iron ore prices have steadied as the Chinese government adopts substantive measures to support the real estate sector.