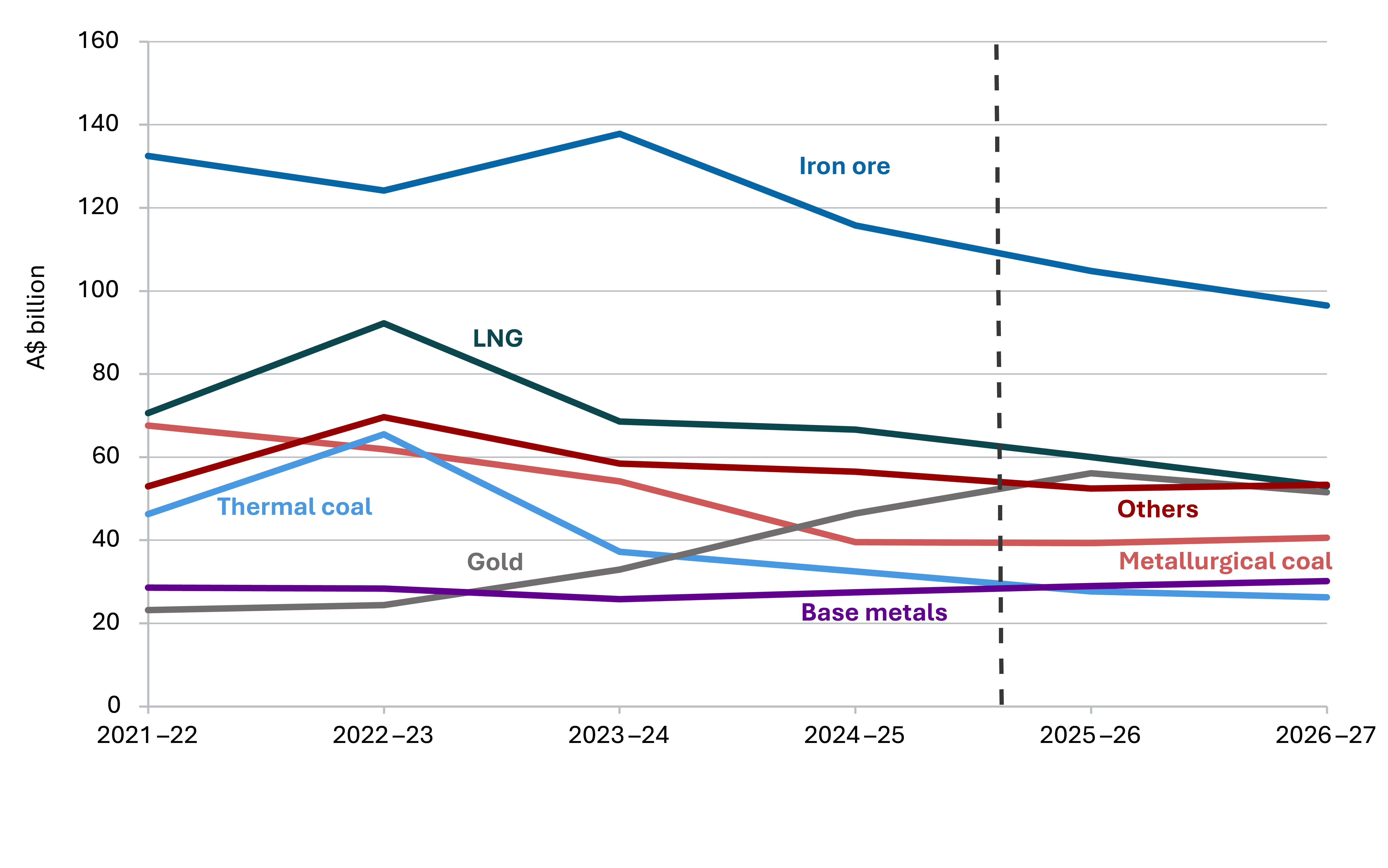

The outlook for Australian resource and energy commodity exports is generally consistent with the March and June 2025 Resources and energy quarterly (REQ) reports:

- The near-term outlook for Australian resources and energy exports has softened slightly as higher trade barriers weigh on world economic growth.

- From an estimated $385 billion in 2024–25, resource and energy export earnings are now forecast to fall to $369 billion in 2025–26, and to $354 billion in 2026–27.

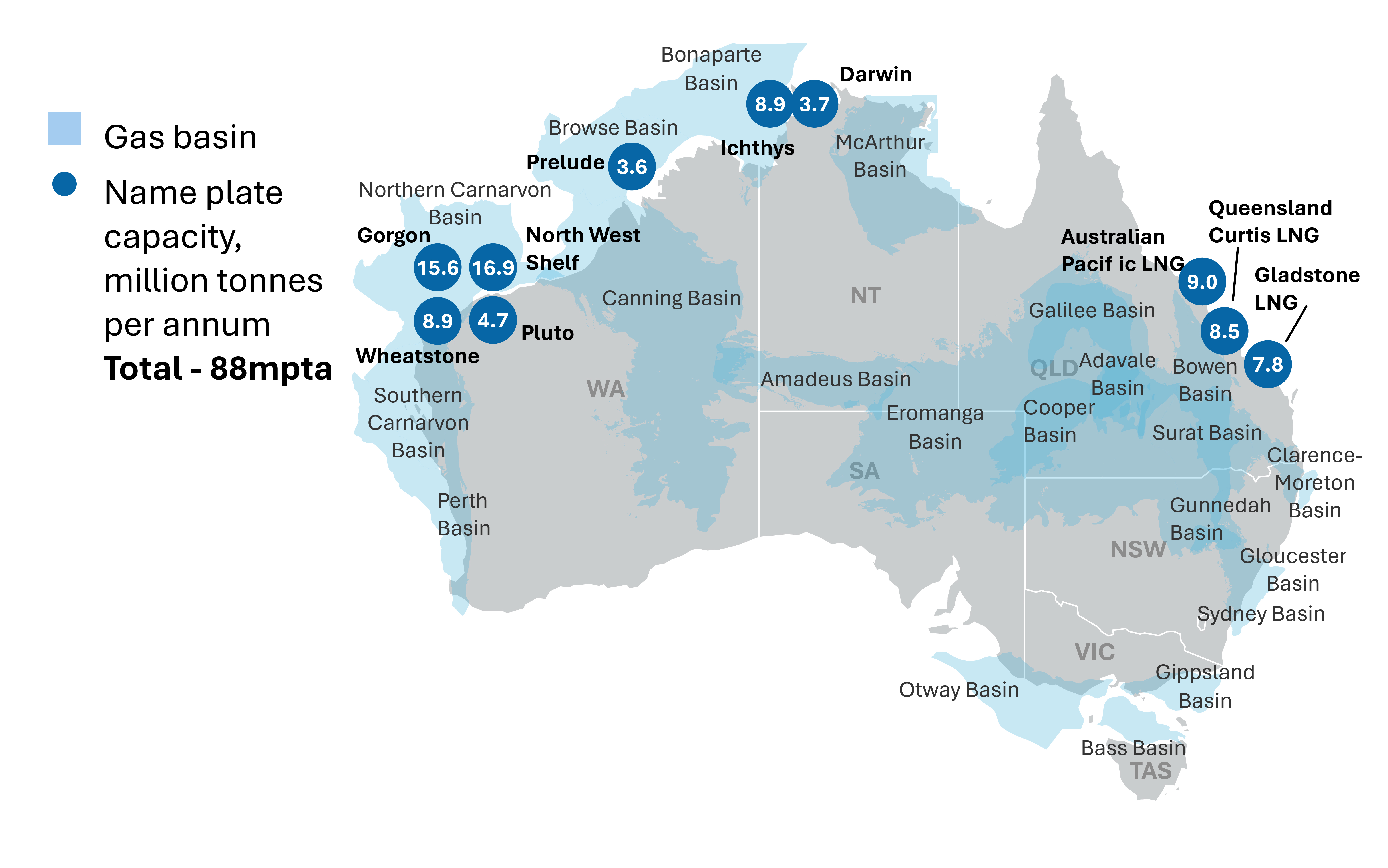

- Higher volumes and prices for gold exports will only partly offset the impact of weaker than expected metallurgical coal and LNG exports in 2025–26 and 2026–27.