The outlook for Australian resource and energy commodity exports is moderately weaker than in the March quarter 2025 Resources and energy quarterly:

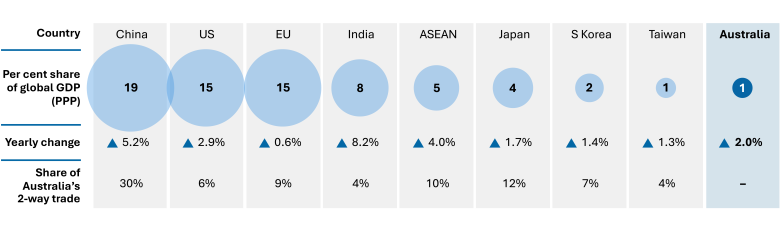

- The near-term outlook for Australian resources and energy exports has softened as rising trade barriers have an adverse impact on world economic activity.

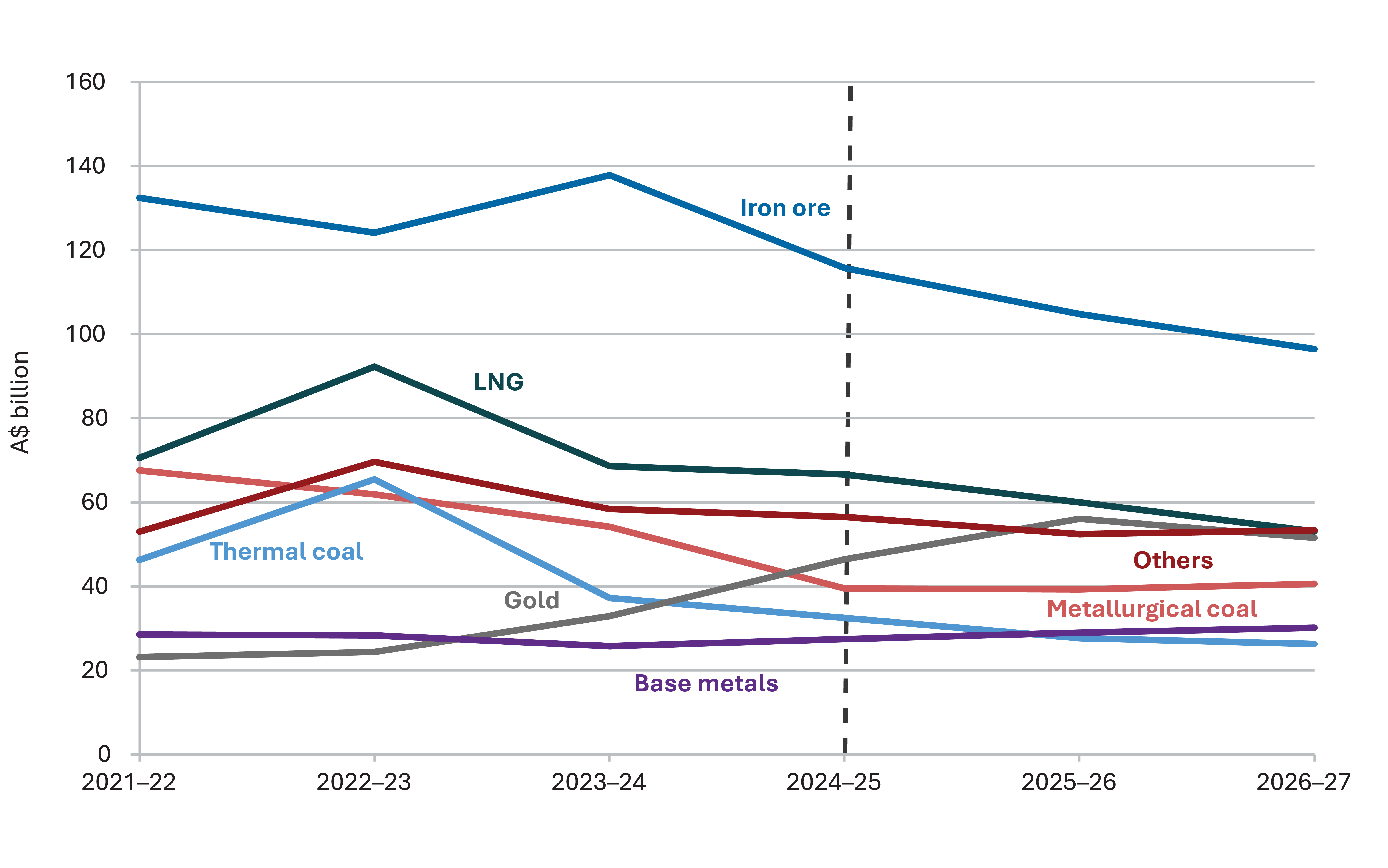

- From an estimated $385 billion in 2024–25, resource and energy export earnings are now forecast to fall to $369 billion in 2025–26. They are forecast to fall further to $352 billion in 2026–27.

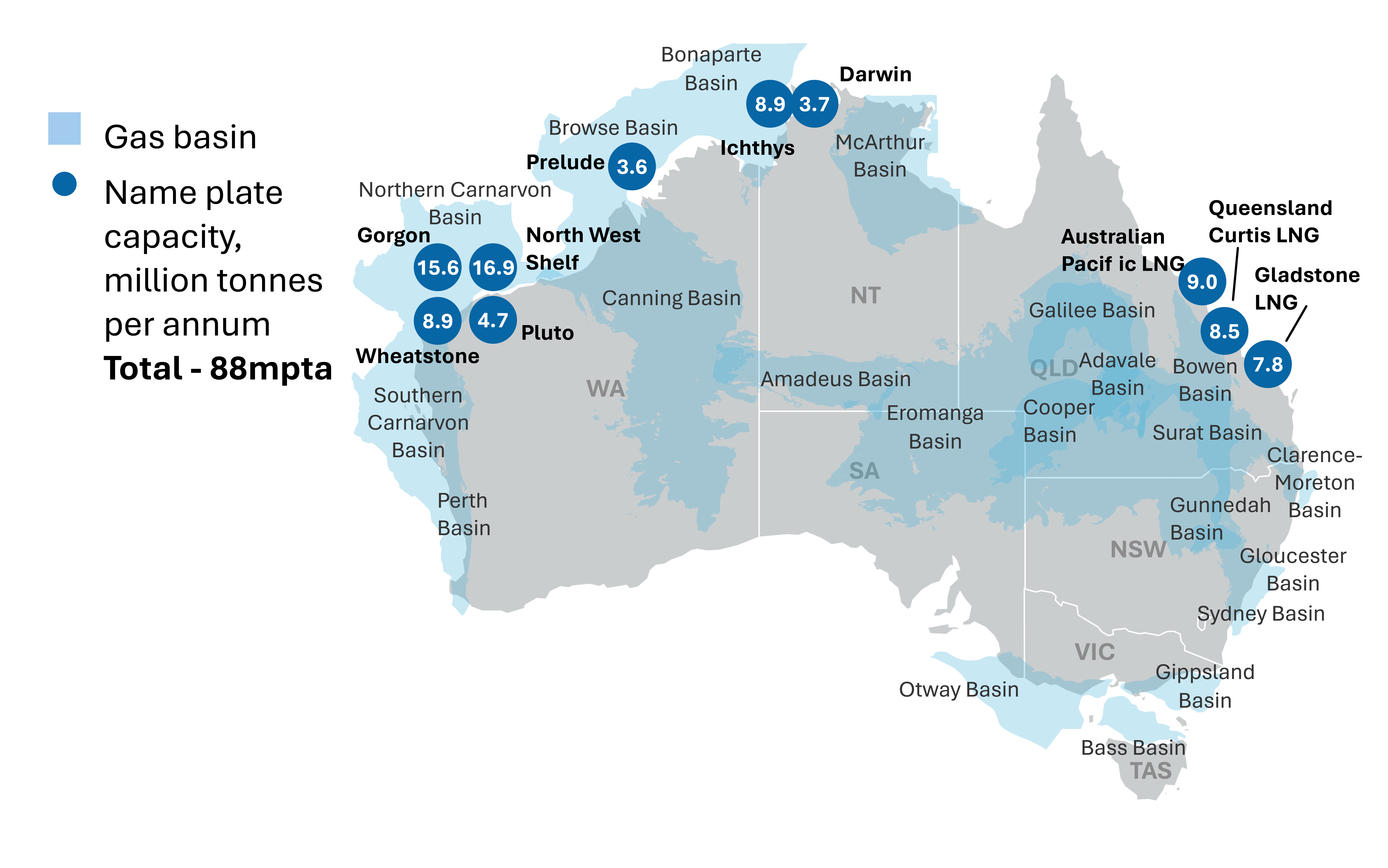

- Higher volumes and prices for our gold exports will only partly offset the impact of weaker than expected iron ore and LNG prices in 2025–26. That’s before gold exports fall back in 2026–27.