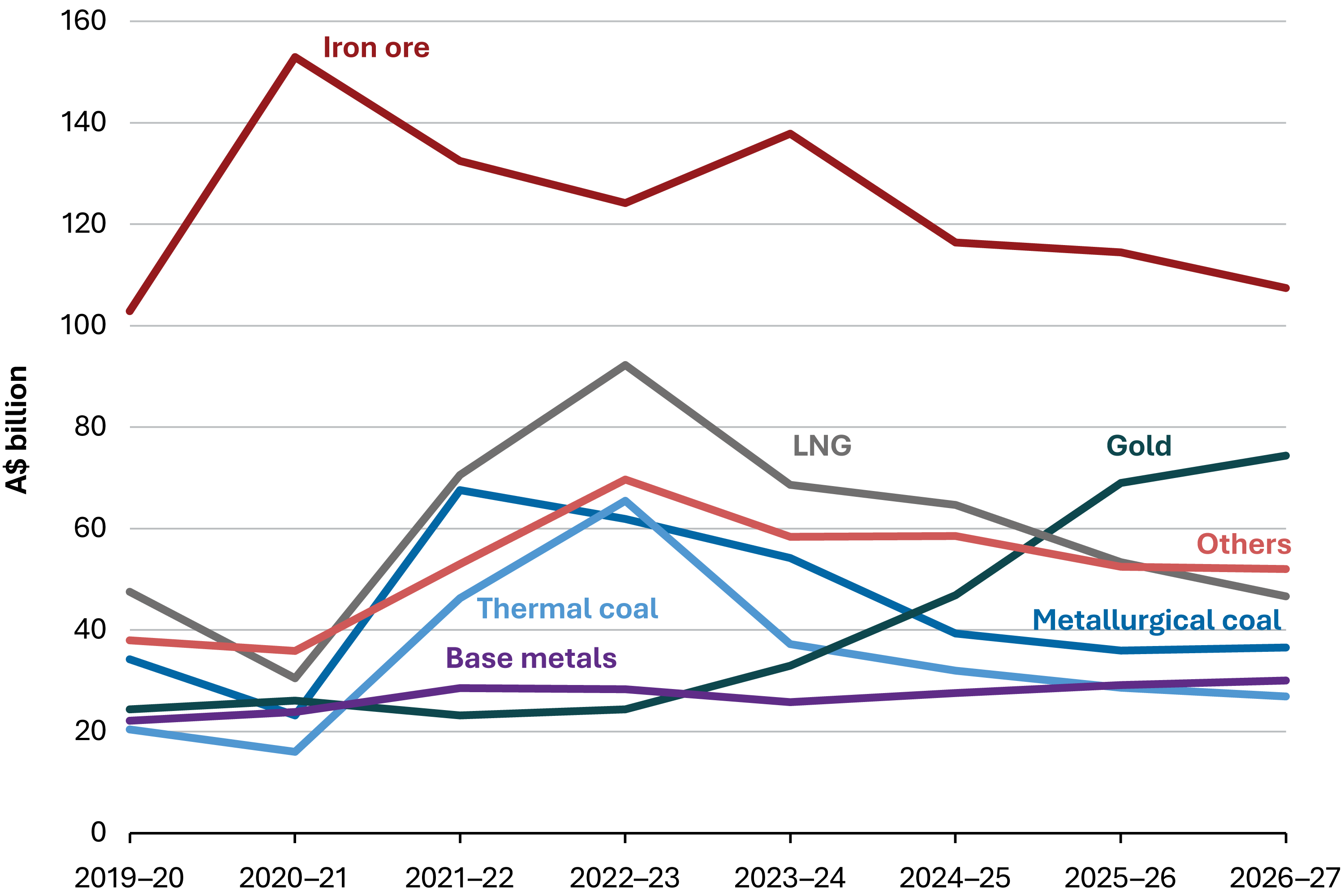

The outlook for Australian resource and energy commodity exports has strengthened, supported by rising gold exports and resilient iron ore exports.

- The outlook for Australian export earnings from resource and energy commodities has strengthened, largely owing to surging gold prices since the September 2025 REQ was published. Export volumes are robust and are expected to increase to close to record levels in 2027.

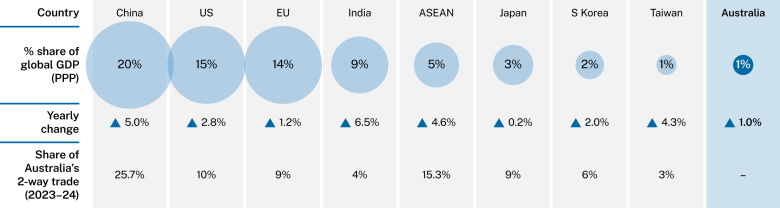

- World growth is relatively soft partly due to the hike in trade barriers in 2025. However, easier monetary and fiscal policy, and investment associated with the use of artificial intelligence and the energy transition, are supporting economic growth and commodity demand. Gold prices have risen as investors seek safe havens and interest rates fall

- From $385 billion in 2024–25, resource and energy export earnings are now forecast to remain approximately constant at $383 billion in 2025–26 and then to ease marginally to $374 billion in 2026–27. Surging gold prices are expected to see gold become our second largest export behind iron ore.