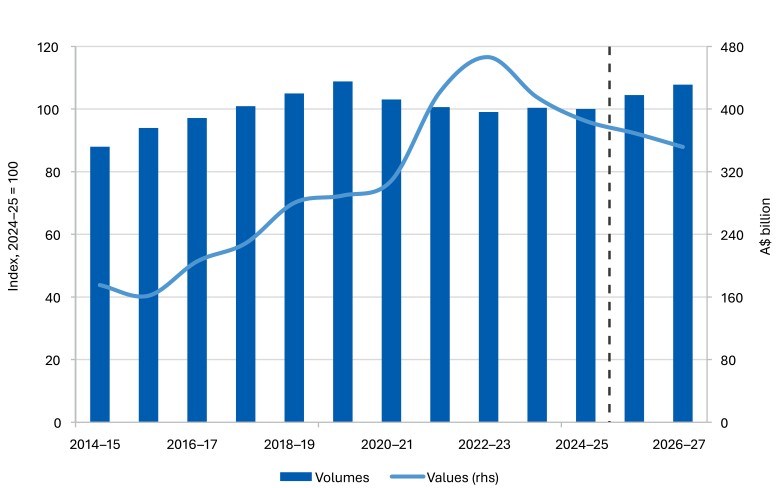

Australia’s resources and energy export volumes continue to grow. However, global economic headwinds will continue to result in lower commodities prices and export earnings.

The June 2025 Resources and energy quarterly (REQ) forecasts a modest rise in commodity export volumes over the next 2 years. However, commodity earnings are expected to fall from $385 billion in 2024–25 to $352 billion by 2026–27. The fall in earnings reflects the impacts of rising trade barriers, relatively weak world economic growth and declining bulk commodity prices.

Compared to forecasts in the March 2025 REQ, earnings forecasts have been revised down by $2 billion in 2024–25, $4 billion in 2025–26, and $8 billion in 2026–27. A surge in gold prices has driven a large upward revision in gold exports in the outlook period. However, weaker revenues for iron ore and LNG are now forecast over the outlook period.