This is according to the June 2024 edition of the Resources and Energy Quarterly (REQ), released today by the Department of Industry, Science and Resources.

The report reaffirms Australia’s place as a crucial global supplier of resource and energy commodities, despite geopolitical risks continuing to challenge world commodity markets. The global energy transition is expected to support Australia’s resource export volumes over the outlook period to 2026.

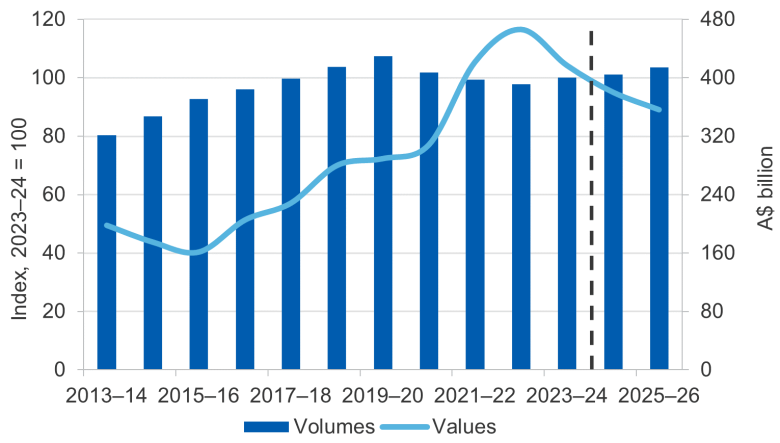

This latest REQ contains 2-year forecasts that show Australia’s resources and energy export earnings are estimated to have declined by 10% (to $417 billion) in 2023–24, from a record $466 billion in 2022–23.

This fall follows relatively weak growth in world demand over the period, as well as rising world commodity supply. It sees export earnings return to long-term levels following record prices after the Russian invasion of Ukraine.

Continuing falls in prices for bulk commodities such as iron ore, coal and LNG are expected to bring earnings down to around $356 billion by 2025–26. This estimate is broadly consistent with the forecast set out in the March 2024 REQ.

The outlook for global growth in 2024 has improved slightly. As inflation returns to target levels, central banks are expected to exit restrictive stances, with growth to pick up in 2025.

The US and some Western European nations are moving to protect their domestic manufacturers against a possible surge in the supply of Chinese electric vehicles (EV) and other low emissions technologies.

The US and UK moves to ban Russian metal from entering the London Metal Exchange and Comex warehouses after 13 April 2024 are likely to lead to more Russian metal towards China and India. Nickel and aluminium will be the most affected.

Highlights from the June REQ include:

- Iron ore remains Australia’s top commodity export. The June 2024 REQ forecasts lower prices over the next two years, although volumes are forecast to increase by 2.3% a year. Exports are forecast to earn $138 billion in 2023–24, $114 billion in 2024–25 and $102 billion in 2025–26.

- Australia’s LNG export revenues are forecast to decline from $69 billion in 2023–24 to $59 billion by 2025–26, due to lower world prices after the record highs of 2022. Export volumes are expected to decrease slightly from a strong level in 2022–23.

- Gold exports are expected to earn a record $33 billion in 2023–24, easing to around $31 billion in 2025–26. Gold prices have risen in 2024 on the back of strong demand from investors and central banks, supported by the prospect of lower global interest rates, geopolitical tensions, and worries over China’s property market.

- The June REQ forecasts a modest improvement in nickel prices, after the world market was hit by a significant increase in supply from Indonesia. Global demand is forecast to grow by 3.6 per cent over the coming two years. However, Australian nickel export earnings are forecast to fall from $3.5 billion this year to $2.3 billion in 2024–25 and $1.5 billion in 2025–26.

- Australia’s copper exports are forecast to rise from $12 billion in 2023–24 to $17 billion in 2025– 26 due to higher prices as a result of an improved manufacturing outlook in China and a ban on Russian metals on the London Metals Exchange and COMEX commodity exchange.

- Australia’s combined thermal and metallurgical coal export earnings are forecast to fall from $90 billion in 2023–24 to $70 billion by 2025–26 due to global prices easing from the 2022 energy price spike.

Risks to the forecast include a broadening in the Hamas-Israel conflict, which could disrupt Middle East oil/LNG supply and raise prices, hurting the world economy. Hurricane season is approaching in the Gulf of Mexico, making some US oil production vulnerable to disruption.

Australian mines, transport routes and ports affected by flooding between 2021-23 will again be at risk in the second half of 2024 with higher than normal odds of a La Niña weather episode.