Australia’s resources and energy export volumes continue to grow while gold prices remain buoyant. However, global economic uncertainty continues to weigh on other commodity prices and earnings.

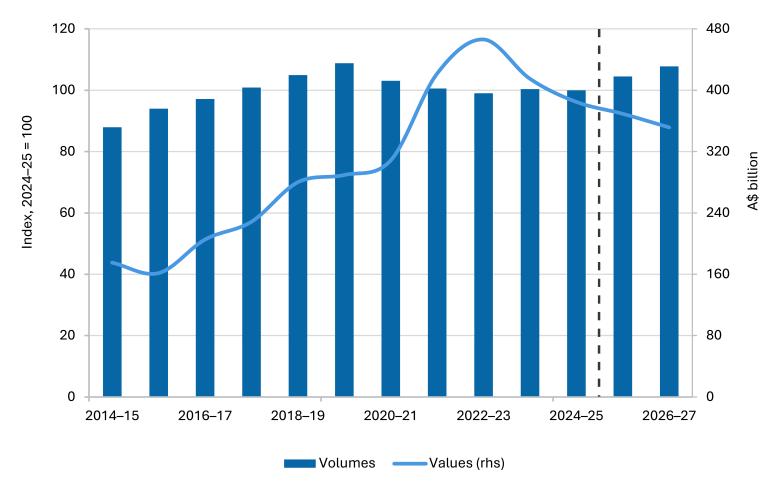

The September 2025 Resources and energy quarterly (REQ) forecasts a modest rise in commodity export volumes over the next 2 years, though prices continue to decline. Record gold prices are expected to offset lower commodity prices as earnings fall from $385 billion in 2024–25 to $354 billion by 2026–27.

Earnings forecasts for 2025–26 are largely unchanged from the June edition of the REQ, and earnings forecasts for 2026–27 have been revised up slightly.