About the Resources and Energy Quarterly

The Resources and Energy Quarterly contains the Office of the Chief Economist’s forecasts for the value, volume and price of Australia’s major resources and energy commodity exports. A ‘medium term’ (five year) outlook for Australia’s major resource and energy commodity exports is published in the March quarter edition of the Resources and Energy Quarterly. The June, September and December editions contain a ‘short term’ (two year) outlook.

Underpinning the forecasts contained in Resources and Energy Quarterly is the Office of the Chief Economist’s outlook for global commodity prices, demand and supply. The forecasts for Australia’s commodity exporters are reconciled with this global context. The global environment in which Australia’s producers compete can change rapidly. Each edition of Resources and Energy Quarterly factors in these changes, and makes appropriate alterations to the outlook, estimating the impact on Australian producers and the value of their exports.

Foreword

Australia’s resource and energy export earnings are forecast to hit a record of $425 billion in 2021–22. While new waves of COVID-19 cases and the Russian invasion of Ukraine are likely to have checked the global economic recovery (and hence commodity demand), Australian resource and energy export earnings are likely to be lifted by surging energy prices.

While this financial year’s result will represent a big increase on 2020–21, exports are expected to ease to around $370 billion in 2022–23, with further falls (in both real and nominal terms) out to 2027. Driving the fall will be a retreat of bulk commodity prices from current historical highs towards more typical levels.

A number of significant events have affected the global resources and energy sector since the publication of the December 2021 edition of the Resources and Energy Quarterly, with the most significant being the Russian invasion of Ukraine. Global commodity markets are likely to be affected not just by war itself, but by the expanding array of sanctions now being applied to Russia. It is too early to tell how broad and long-lasting these sanctions will be, but it does appear that world trade and investment flows will become more bifurcated in line with geopolitical alliances over the outlook period. Commodity supply chains will be forced to adjust.

China has relaxed macroeconomic policies in recent months, in an attempt to boost economic growth following last year’s slowdown. In January 2022, the IMF forecast China’s GDP growth to be 4.8% in 2022 and 5.2% in 2023 — a cut from prior forecasts, and one with significant implications for resource and energy commodity demand. Rising gas and coal prices caused by the Russian invasion of Ukraine will also affect China, given its high sensitivity to energy prices. China has also been forced to manage renewed outbreaks of the COVID-19 pandemic in the March quarter 2022, with recent lockdowns affecting tens of millions of people.

Over the last few months, a new (Omicron) variant of the COVID-19 virus has swept the world, and severe weather conditions have disrupted the output and export of bulk commodities. However, the La Niña weather pattern appears set to end in mid-2022, removing some threat to the supply of resource and energy commodities.

Inflation has picked up in most major economies, and many major central banks have begun tightening monetary policy. With global energy prices at record levels, and energy inventories in the Northern Hemisphere well below normal, prices (and thus inflation) will face more upward pressure in the near term.

Risks to forecast export earnings in 2021–22 and 2022–23 exist in both directions. A severe disruption to commodity supply emanating from Russia’s invasion of Ukraine could push prices up further. There is potential for a (related) further rise in global inflation, and a risk of tighter monetary policy in response. New, vaccine-resistant COVID-19 strains could emerge. In the latter half of the outlook period, global efforts to build energy and transport systems based on low emission sources may help to offset the impact of energy exports coming off their peak.

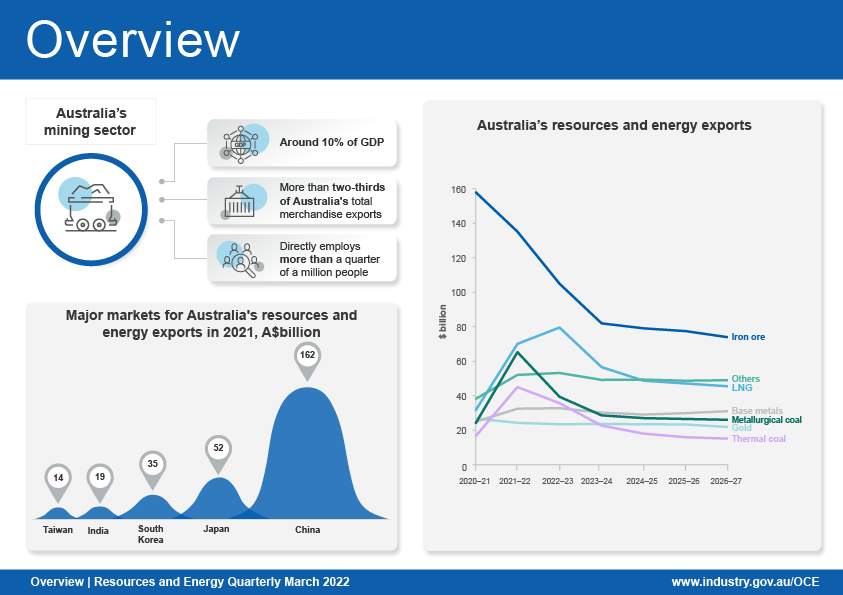

Overview

Australia’s resource and energy export earnings to again reach a new record in 2021–22

- The outlook for Australia’s mineral exports remains strong, as the world economy rebounds from the impact of the COVID-19 pandemic and energy shortages persist. High prices, good volume growth and a weak Australian dollar are driving a surge in export earnings. Some decline in prices is likely in 2023, as supply rises and demand growth moderates.

- Export earnings are forecast to lift by 33% to a record $425 billion in 2021–22, then fall to $370 billion (in real terms) in 2022–23. Earnings should steady out at $263–293 billion over the rest of the outlook.

- Energy prices have jumped, on the prospect that the fallout from Russian invasion of Ukraine will intensify energy shortages. Commodity prices should settle back, as inventories rebuild and as world trade re-organises.

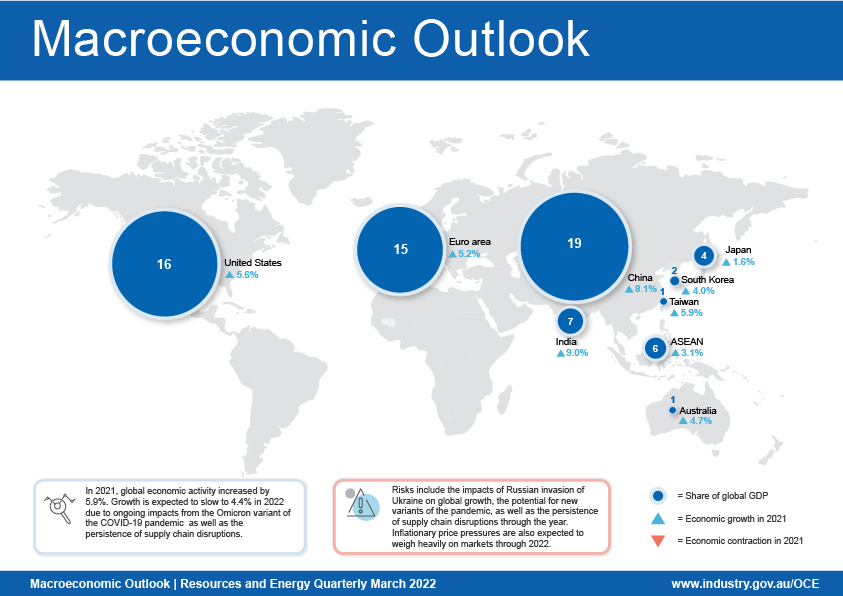

Macroeconomic outlook

The pace of the global recovery likely to slow in 2022

- The global recovery is expected to continue in 2022, but at a slower pace than in 2021. This slower growth will reflect the ongoing impacts from the Omicron variant of the COVID-19 pandemic across major nations, as well as the persistence of supply chain disruptions into 2022.

- The world economy is forecast to grow by 4.4% in 2022 and 3.8% in 2023. Global growth is then expected to trend toward lower, longer-run levels from 2024 as the pent up demand impulse recedes, and as stimulatory fiscal and monetary policies are scaled back.

- Risks to global growth in the short term remain skewed to the downside. This reflects the flow-on impacts from Russian invasion of Ukraine, the potential for new variants of the pandemic, as well as the persistence of supply chain disruptions through the year. Inflationary price pressures are also expected to weigh heavily on markets through 2022.

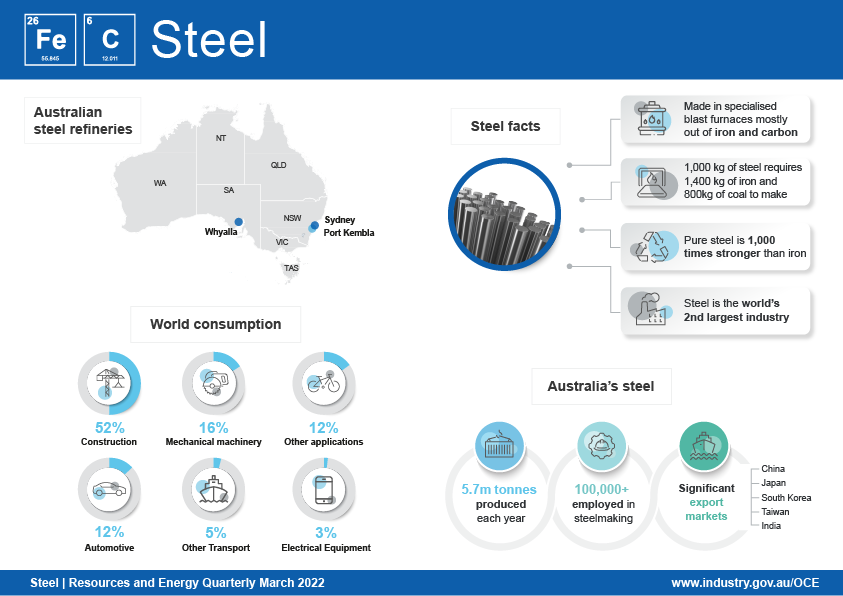

Steel

Growth in world steel production to ease from 2022

- World steel consumption is estimated to have grown 3.8% year-on-year in 2021, reflecting a rebound in industrial production as the world recovers from the COVID-19 pandemic.

- Global steel production rose by 3.7% year-on-year in 2021. A recovery among producers such as the US, Europe, Japan, and India more than offset a 3.0% fall in output in China, the world's largest producer.

- World steel output is forecast to grow by 2.2% in 2022. However, the potential for further energy shortages amongst major producers, and the Russian invasion of Ukraine presents significant risks to this forecast.

- Over the outlook to 2027, world steel output is projected to grow by an average of 1.2% a year. Low growth in China’s steel output is expected to be offset by more rapid growth from India, Brazil and South East Asia.

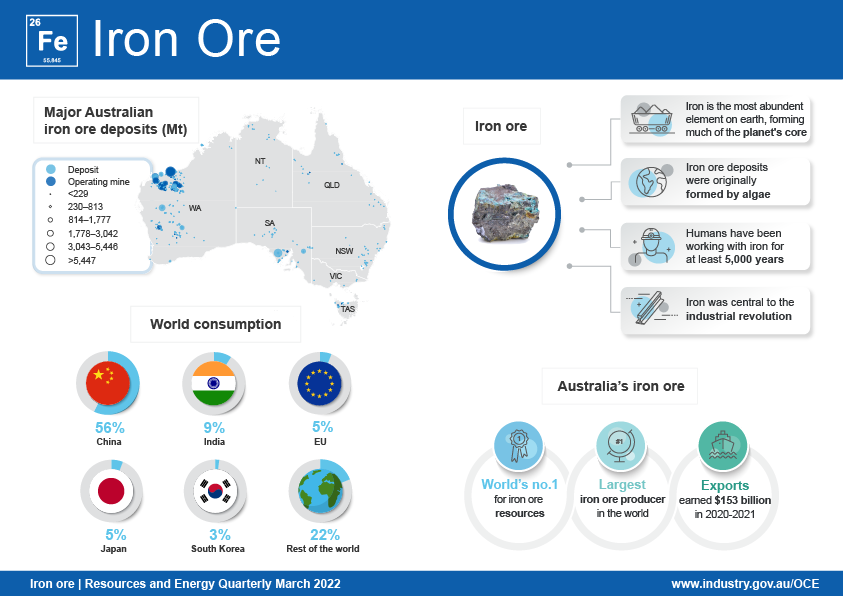

Iron ore

Iron ore prices recovering after considerable falls in the second half of 2021

- After falling more than 60% through the second half of 2021, iron ore prices have rebounded in early 2022 (to around US$140 per tonne by mid-March). This reflects an improvement in China’s steel output in recent months, growing expectations of a more accommodative policy stance in China this year, and current supply concerns due to the Russian invasion of Ukraine.

- Australian export volumes are projected to grow steadily over the outlook period, from 872 million tonnes in 2021–22 to 1,044 million tonnes by 2026–27. This reflects the ramp up in production of several new and replacement mines in Western Australia.

- Australia's iron ore export earnings (in real terms) are projected to ease over the outlook period, from $135 billion in 2021–22 to $105 billion in 2022–23, and falling to $74 billion by 2026–27.

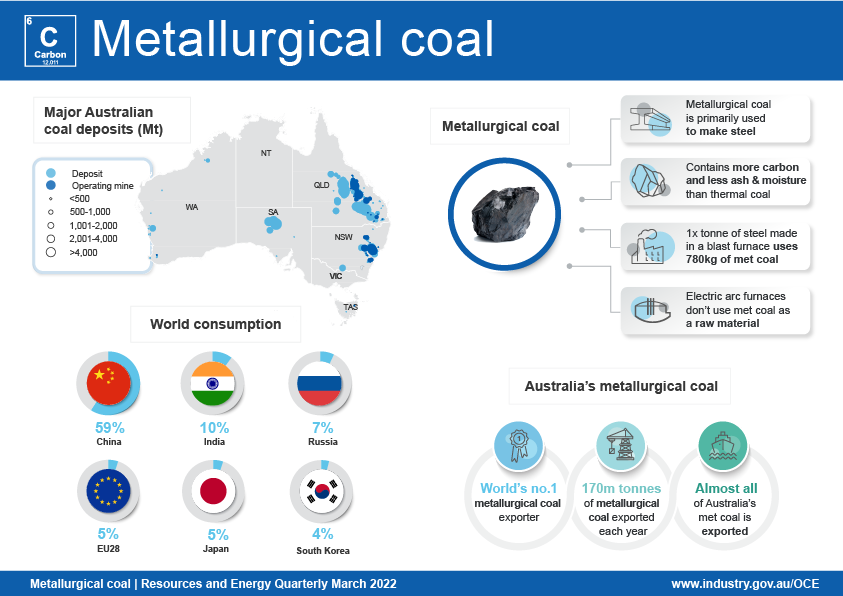

Metallurgical coal

Metallurgical coal export earnings have lifted strongly in recent months

- Metallurgical coal prices hit historic highs as the year turned, and surged again following the Russian invasion of Ukraine. The Australian premium hard coking coal price is forecast to average over US$300 a tonne in 2022, but is expected to fall by almost half as supply conditions return to normal in 2023. Prices are ultimately expected to reach US$133 a tonne by 2027 (in real terms).

- Australia’s exports are forecast to rise from 171 million tonnes in 2020–21 to 184 million tonnes by 2026–27. The result reflects increased production in NSW and Queensland.

- Australia’s metallurgical coal export values are forecast to track with price movements, rebounding from $24 billion in 2020–21 to peak above $60 billion in 2021–22, before falling back to $26 billion by 2026–27.

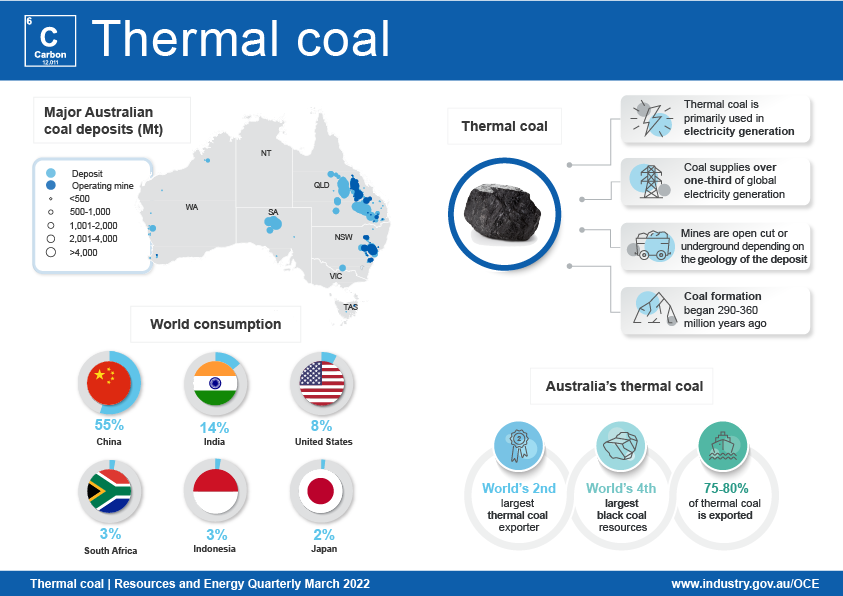

Thermal coal

Australia’s thermal coal export earnings have risen as global supply disruptions intensify

- Global thermal coal spot prices have spiked, as increasing Chinese demand coincides with weather disruptions, supply impacts from COVID-19 outages, and the fallout from the Russian invasion of Ukraine. As more normal conditions return, the Newcastle benchmark price is forecast to ease from a peak of US$184 a tonne in 2022 to around US$60 a tonne by 2027 (in real terms).

- Australian thermal coal exports declined from 213 million tonnes in 2019–20 to 192 million tonnes in 2020–21, but are expected to recover back to a 204–207 million tonne range over the forecast period.

- Surging prices are expected to push export values to a peak of $45 billion in 2021–22, with a gradual (price-driven) easing to a more typical level of around $15 billion (in real terms) by 2026–27.

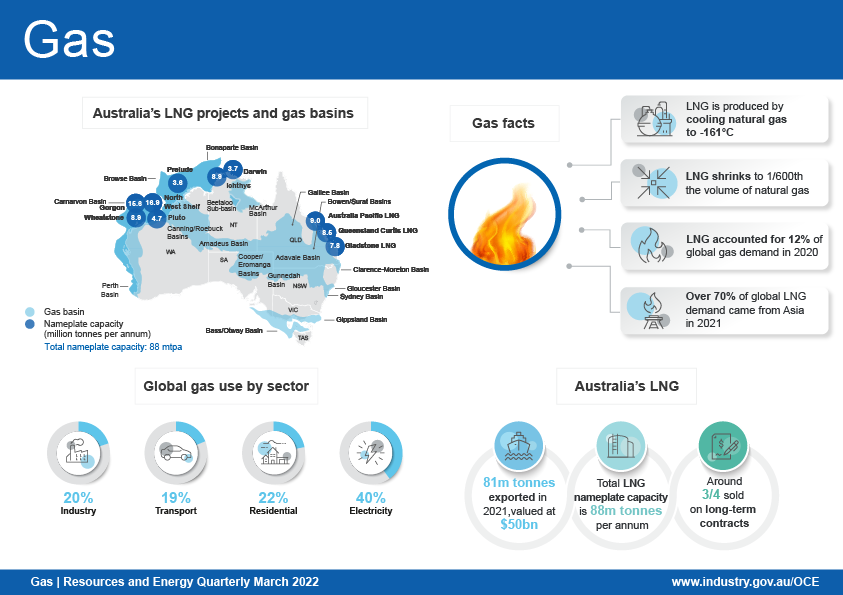

Gas

Australia’s LNG export earnings to rebound strongly in 2021–22, as prices recover

- Asian LNG spot prices and oil-linked contract prices are expected to remain high throughout 2022 and 2023, before declining back to more typical levels in the latter half of the outlook.

- Australian export volumes are forecast to increase to 82 million tonnes in 2021–22, as technical issues offset higher capacity utilisation at other plants. Volumes should then fluctuate between 79 and 81 million tonnes over the outlook.

- Australia’s LNG exports earnings are forecast to rise from $30 billion in 2020–21 to $70 billion in 2021–22, and $82 billion in 2022–23 as oil-price linked contract prices surge. Export earnings are forecast return to around $52 billion by the end of the outlook period.

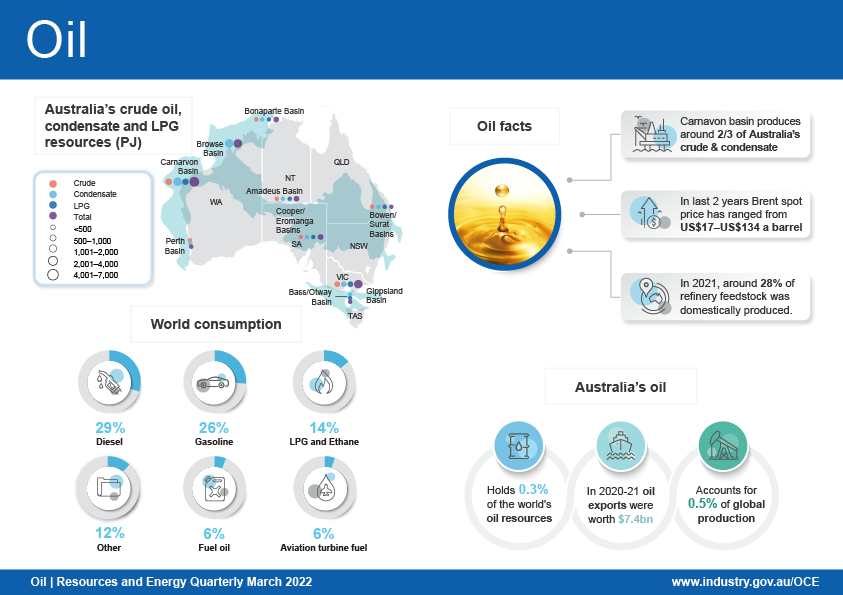

Oil

Australian crude and condensate export earnings to lift significantly with higher prices

- Significant uncertainty surrounds global oil price forecasts, with the fallout from Russia’s invasion of Ukraine driving global supply concerns in the midst of rising global demand. This chapter includes three price scenarios, with the base case scenario forecasting a Brent crude price averaging US$108 a barrel in 2022, peaking in the middle of the year and then gradually declining.

- Australian crude oil and feedstock exports in 2021–22 are forecast to increase by 1.7% to 281,000 barrels a day. Exports are projected to lift later in the outlook period, as a number of new oil projects come online.

- Soaring oil prices are expected to lift Australian oil export earnings by 86% to $13.8 billion in 2021–22, with earnings then holding steady in 2022-23.

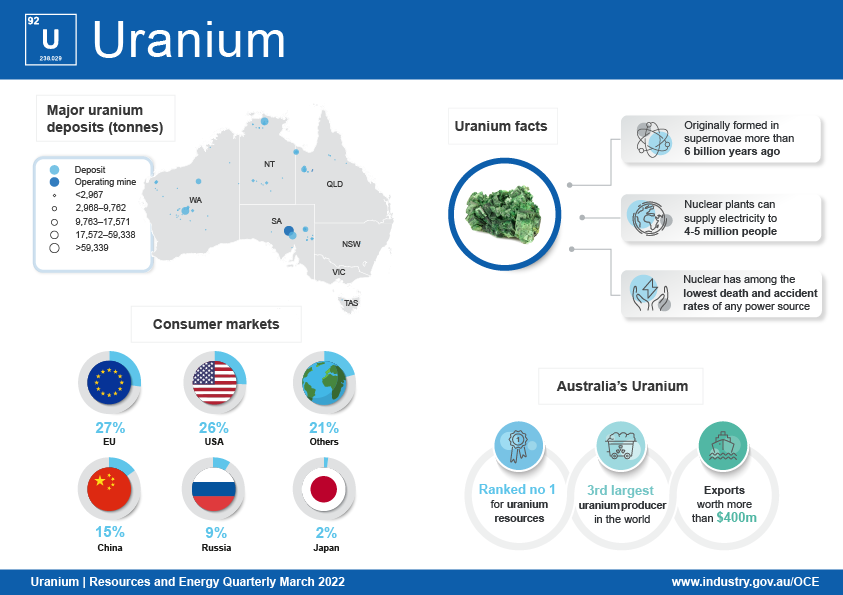

Uranium

Uranium prices are rising, potentially offsetting lower export volumes

- Uranium prices are forecast to lift from US$36.50 a pound in 2021 to US$47 a pound by 2027 (in real terms). A long period of low prices resulted in many uranium projects being deferred or cancelled, leading to potential uranium shortfalls during the outlook period.

- Australian production is forecast to decline from 2021, as the number of active uranium mines falls from three to two.

- Price growth is expected to see uranium export values increase from $500 million in 2021–22 to $729 million by 2026–27 (in real terms).

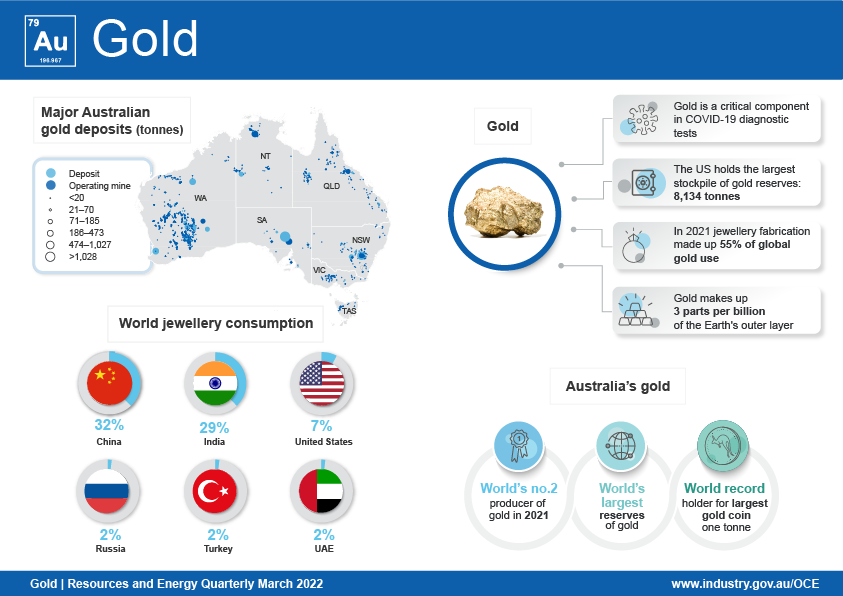

Gold

Australia’s gold exports are projected to fall to $22 billion in real terms in 2026-27

- The fallout from the Russian invasion of Ukraine is likely to support gold demand and prices in the very short term. However, the gold price is forecast to slide from an average of US$1,770 an ounce in 2022 to US$1,380 an ounce in 2027 in real terms as real bond yields lift.

- Production from new mines and existing mine expansions is expected to boost gold mine production to 374 tonnes in 2026–27.

- Lower gold prices are expected to push the value of Australia’s gold exports down to $22 billion in 2026–27 in real terms.

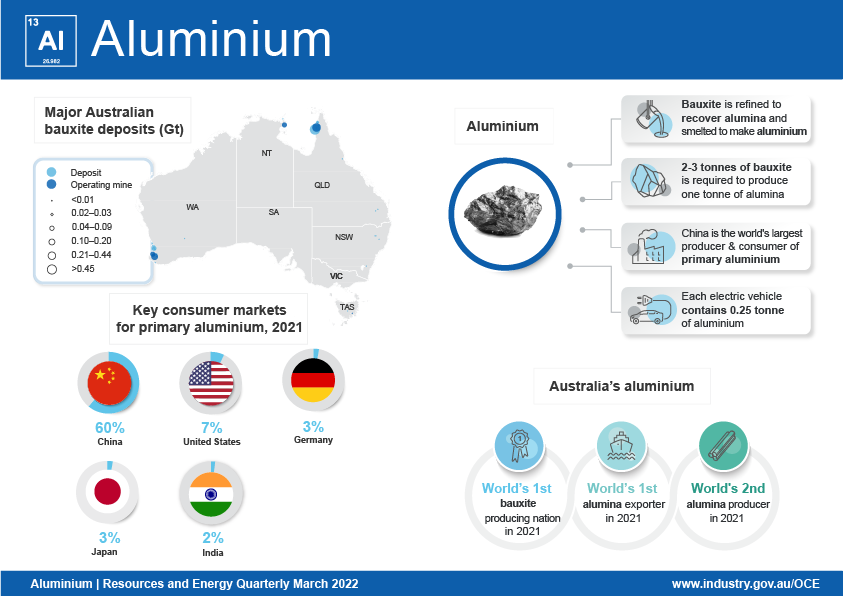

Aluminium, alumina and bauxite

Australia’s aluminium, alumina and bauxite export earnings to rise to $16 billion in real terms in 2021–22

- The fallout from the Russian invasion of Ukraine is likely to push primary aluminium prices higher in the short term, averaging US$3,100 a tonne in 2022. The global economic recovery, supply constraints and strong demand, are expected to see continued support for primary aluminium prices. Prices are projected to remain high, averaging US$2,650 a tonne by 2027.

- A restart of idled capacity at the Portland Aluminium smelter from the September quarter 2022 is expected to boost Australian primary aluminium output to 1.6 million tonnes a year by 2022–23. Annual Australian alumina output is expected to be broadly steady over the outlook period, remaining at 21 million tonnes. Australian bauxite output is projected to reach 106 million tonnes in 2023–24, before falling to 101 million tonnes in 2026–27.

- Australia’s aluminium, alumina and bauxite export earnings are forecast to increase by 32% to $16 billion in real terms in 2021–22, before falling to $15 billion by the end of the outlook period.

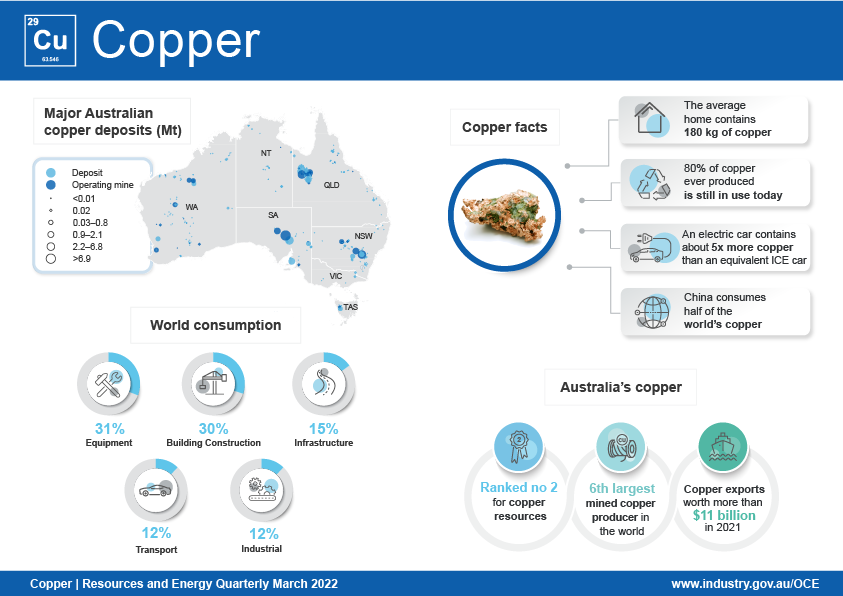

Copper

Record copper prices support export earnings and Australia’s development potential

- Copper prices increased by 51% to US$9,300 in 2021, as global industrial activity recovered from COVID-19. Prices are expected to ease slightly as new mine production comes online over the outlook period, stabilising around US$8,000 a tonne (in real terms) in 2027.

- Australia’s copper exports are projected to fall to 834,000 tonnes in 2021–22 as scheduled maintenance is completed. Copper exports are expected to grow to over 1 million tonnes in 2026–27, as high copper prices incentivise production from new mines and mine expansions (see Australia section).

- As prices and output grow, Australia’s copper export earnings are projected to lift from $11.7 billion in 2020–21 to $13.8 billion (in real terms) in 2026–27, up an average 2.6% a year.

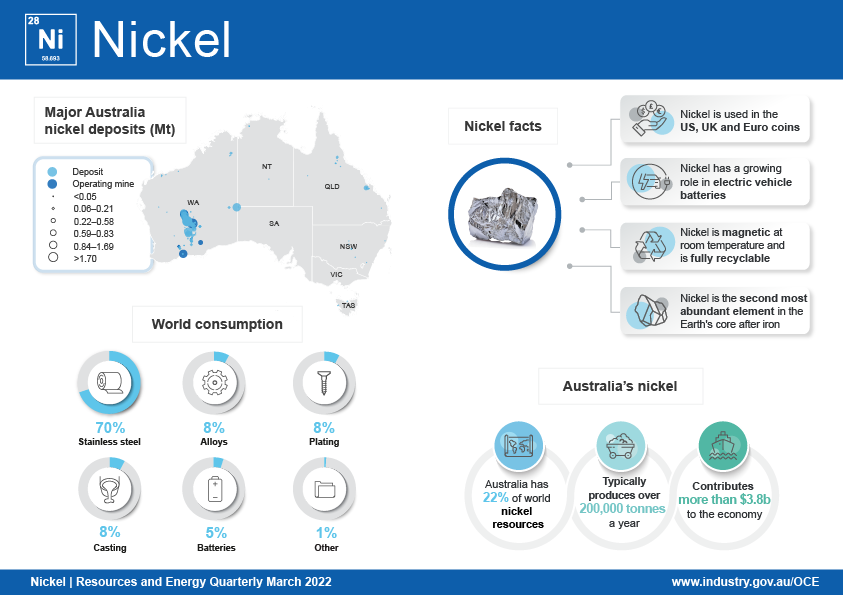

Nickel

The market for battery-grade Nickel is expected to tight over the outlook period

- Nickel prices are expected to average US$24,875 in 2022, over declining stocks of battery grade material and the Russian invasion of Ukraine. Prices are expected to ease in the medium term, before facing upward pressure from significant demand from electric vehicle manufacturing. The forecast nickel price in 2027 is US$21,100 (in real terms) by 2027.

- Australia’s export volumes are forecast to rise from 273,000 tonnes in 2021–22 to 326,000 tonnes in 2026–27. Higher nickel prices may incentivise further expansion in nickel production to capitalise on the movement towards low-emission technologies.

- Export earnings are forecast to remain stable as higher export volumes compensate for easing nickel prices. Australia’s export earnings are forecast at $7.0 billion in 2021–22, and at $7.3 billion (in real terms) in 2026–27.

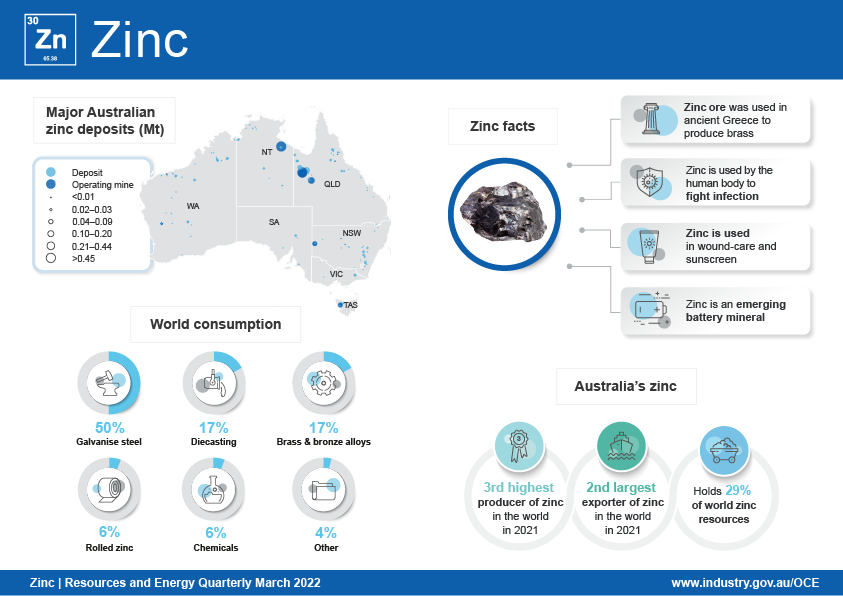

Zinc

Infrastructure spending providing a boost to world zinc demand

- The LME zinc spot price is forecast to average around US$3,600 a tonne in 2022, with robust global construction activity expected this year, as well as continued refined supply shortages (particularly in Europe).

- Prices are expected to ease over the outlook to reach around US$2,400 a tonne (in real terms) by 2027, as global supply rises and consumption growth normalises.

- Australia’s zinc production is forecast to be around 1.4 million tonnes in 2021–22, and rise by 7.8% to almost 1.5 million tonnes in 2022–23. Over the outlook, production is expected to remain relatively flat to 2026–27.

- Australia’s zinc export earnings are forecast to increase to around $4.3 billion in 2021–22. Earnings are then forecast to ease to $4.0 billion in 2022–23 (in real terms). Export earnings are then projected to fall over the outlook, to reach $2.8 billion in 2026–27.

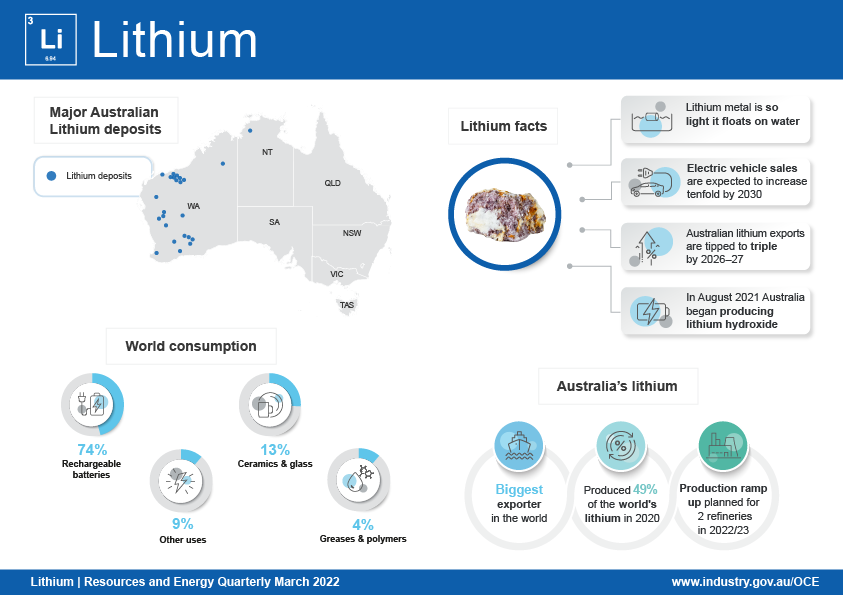

Lithium

Rising prices for lithium are supporting the recovery of Australian producers with lithium hydroxide production underway.

- Spodumene prices are projected to rise from an average US$660 a tonne in 2021 to US$1,325 a tonne in 2022, before moderating to around US$800 a tonne in 2027 (in real terms). Lithium hydroxide prices are projected to rise from US$17,970 a tonne in 2021 to US$27,620 a tonne in 2022, before easing to US$13,140 (in real terms) by 2027.

- Australia’s lithium production is projected to more than triple over the outlook period, rising from 224,000 tonnes of lithium carbonate equivalent (LCE) in 2020–21 to 692,000 tonnes of LCE in 2026–27.

- Australia’s lithium export earnings are projected to rise from $1.0 billion in 2020–21 to $6.7 billion in 2026–27 (in real terms), as lithium hydroxide production rises. A further 5 lithium hydroxide refining operations are projected to commence operations in Australia by 2026-27.